Why the CLARITY Act could explode crypto adoption

A deep dive into the United States Digital Asset Market Clarity Act of 2025 as it stands as a pivotal crossroad for 2026

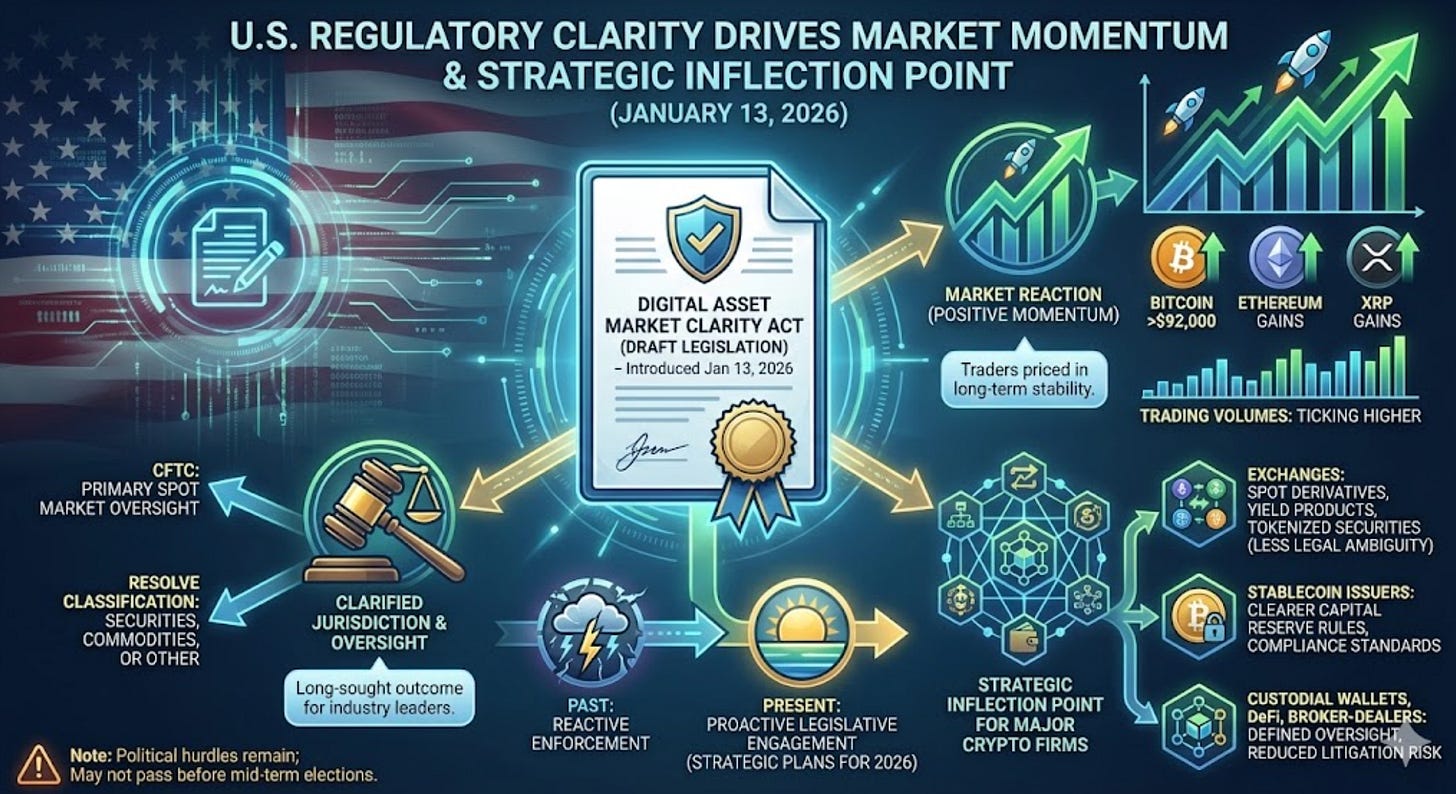

The Digital Asset Market Clarity Act of 2025 (commonly known as the CLARITY Act, H.R. 3633) represents one of the most significant attempts in U.S. history to provide comprehensive regulatory clarity for cryptocurrencies and digital assets. Passed by the House of Representatives in July 2025 with strong bipartisan support (294-134 vote), the bill now awaits action in the Senate, where committee markups—originally eyed for mid-January 2026—have been delayed to late January amid ongoing negotiations for broader consensus.

This legislation aims to end years of regulatory uncertainty, where the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have often clashed over jurisdiction, leading to enforcement-driven approaches, innovation flight overseas, and hesitation from institutional investors.

The Core Problem It Solves

For over a decade, the U.S. crypto ecosystem has operated in a gray area. Many tokens are treated as securities under the SEC’s broad interpretation (via the Howey Test), triggering registration requirements and lawsuits. Others, like Bitcoin and Ether, are viewed as commodities under CFTC purview—but spot markets (everyday buying/selling) lacked clear oversight. The result: lawsuits against major exchanges, offshore migration of projects, and limited mainstream adoption.

The CLARITY Act draws bright lines to resolve this turf war and foster a safer, more innovative environment.

Key Provisions of the CLARITY Act

Clear Definitions and Asset Classification

Digital asset: Any token or coin recorded on a blockchain.

Digital commodity: Mature, decentralized tokens (e.g., Bitcoin, Ether post-decentralization) where value derives from network utility rather than centralized promises. These shift primary spot-market oversight to the CFTC.

Investment contract assets (securities-like): Tokens sold with expectations of profit from a promoter’s efforts. These remain under SEC jurisdiction for initial offerings. A “maturity test” (based on decentralization, open-source nature, and lack of centralized control) allows tokens to “graduate” from SEC to CFTC oversight as networks mature.

Split Regulatory Oversight

CFTC gains authority over spot trading, exchanges, brokers, and dealers for digital commodities.

SEC retains control over primary issuances and anti-fraud enforcement in certain cases.

This division ends overlapping claims and provides a clear path for platforms to register and operate legally.

Platform and Exchange Requirements

Fast-track/provisional registration with the CFTC for crypto exchanges and brokers.

Mandated protections: Segregated customer funds, proof-of-reserves audits, anti-manipulation rules, and conflict-of-interest safeguards.

Exemptions for truly decentralized activities (e.g., running nodes, validating, or open-source development in DeFi protocols without a central operator), while anti-fraud rules still apply.

Fundraising and Innovation Support

Exemptions from full SEC registration for certain token sales on mature blockchains (capped, e.g., at $75 million in 12 months in drafts).

Protections for non-controlling developers and decentralized governance.

These features aim to keep capital raising and project development in the U.S.

Additional Safeguards

Enhanced consumer protections, including asset segregation in bankruptcy scenarios.

Provisions allowing banks to custody and stake digital assets under regulated frameworks.

Anti-CBDC elements prohibiting the Federal Reserve from issuing direct-to-consumer central bank digital currencies without congressional approval.

The bill is not without debate—issues like stablecoin yield restrictions (activity-based vs. passive rewards), stronger DeFi oversight, and AML enhancements remain points of contention in Senate negotiations.

Current Status (as of January 14, 2026)

The House version passed in July 2025. In the Senate, Banking and Agriculture Committees have released discussion drafts (building on the CLARITY Act and related proposals like the Responsible Financial Innovation Act). A markup originally scheduled for January 15 has been postponed to the final week of January to secure more bipartisan support and refine language on key sticking points.

Industry observers and prediction markets (e.g., Polymarket) currently assign high odds—around 70-80%—for passage sometime in 2026, though midterm elections later in the year could influence momentum. White House crypto adviser David Sacks and key senators have signaled strong push for January action.

If enacted, implementation would phase in over 12-18 months, with joint SEC-CFTC rulemakings.

Why It Matters: Potential Impact

Passage could mark a turning point for U.S. crypto:

End “regulation by enforcement” and reduce legal risks.

Attract institutional capital (Wall Street funds, banks) through clear rules.

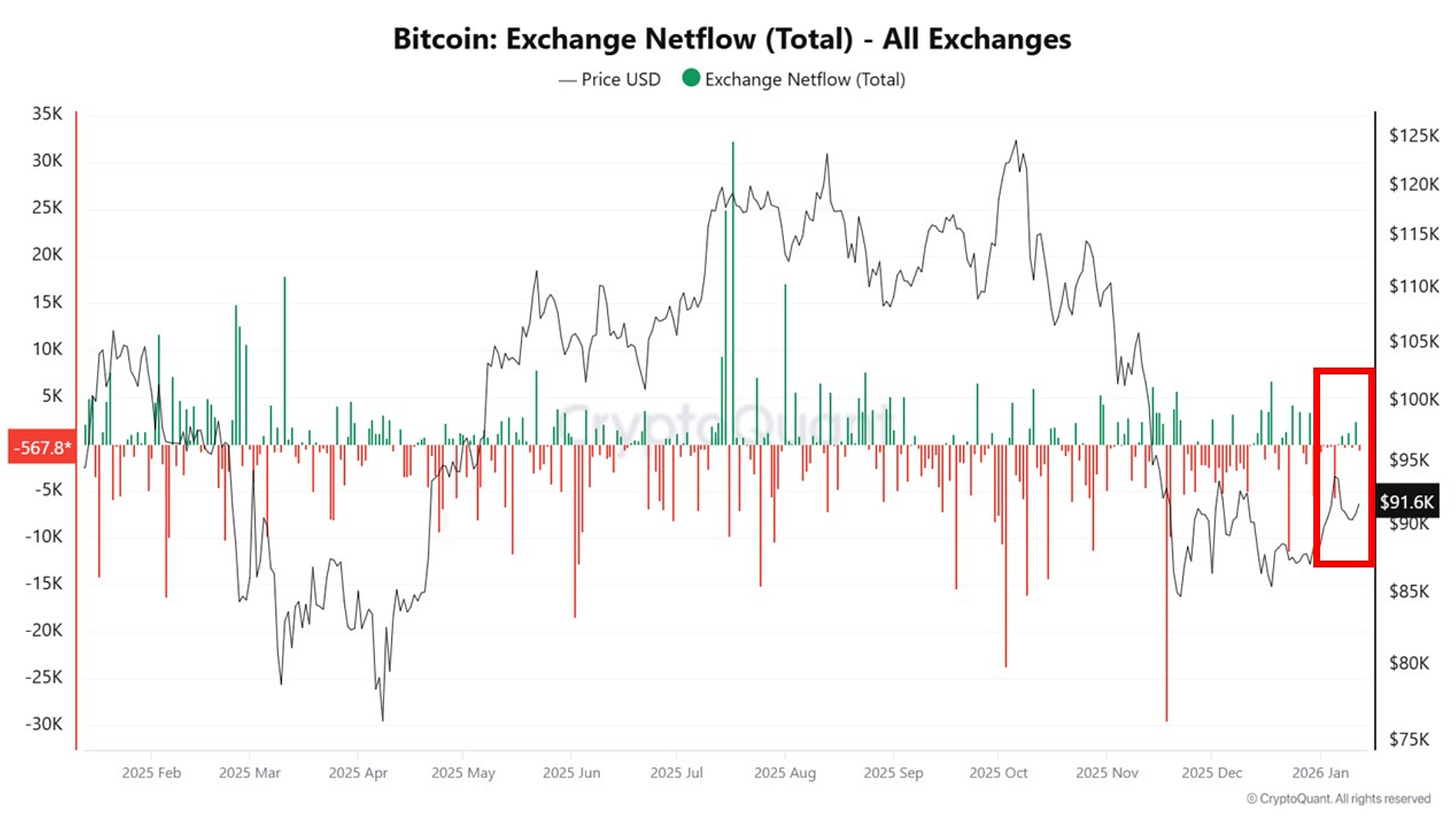

Boost prices and adoption for assets like Bitcoin and Ethereum as clarity unlocks liquidity.

Retain talent and innovation domestically rather than losing it to jurisdictions like Singapore or Dubai.

Following the GENIUS Act’s success for stablecoins in 2025, the CLARITY Act could complete the market structure puzzle, positioning the U.S. as a leader in blockchain innovation.

For the full bill text, see Congress.gov (H.R. 3633). Track updates via GovTrack.us, congressional committees, or reliable crypto policy sources like Latham & Watkins’ trackers.This framework isn’t perfect—critics call for more robust consumer protections or DeFi safeguards—but it offers the clearest path yet to balanced, innovation-friendly regulation. As 2026 unfolds, the CLARITY Act could redefine crypto’s role in the American financial system.

In conclusion, the Digital Asset Market Clarity Act of 2025 stands at a pivotal crossroads as of mid-January 2026. With the House having delivered strong bipartisan passage last July, the Senate’s upcoming markups—now targeted for the final week of January following recent delays—represent the critical next step toward enacting long-overdue regulatory structure for digital assets.

While debates over stablecoin rewards, DeFi safeguards, and bipartisan compromises continue, the momentum—bolstered by industry advocacy, White House support, and cross-aisle leadership—suggests 2026 could deliver the clarity the market has awaited for over a decade. If enacted, this legislation won’t just regulate crypto; it will legitimize and accelerate its role in modern finance, bridging the innovative promise of blockchain with the stability and trust that traditional markets demand.

The path forward remains one of careful negotiation, but the stakes are clear: rules of the road that protect users while unleashing potential—or continued uncertainty that risks America’s edge in the digital economy. As developments unfold in the coming weeks, the outcome will shape not only crypto’s trajectory but the future of financial innovation in the United States.

Let’s Make Crypto Normal

Justin Benjamin

Make Crypto Normal!

The more regulation we have, the less people want crypto.