A Normal Crypto Cheat Sheet: A Total Crypto Market Overview

Deep dive into a detailed total cryptocurrency market overview

Abstract

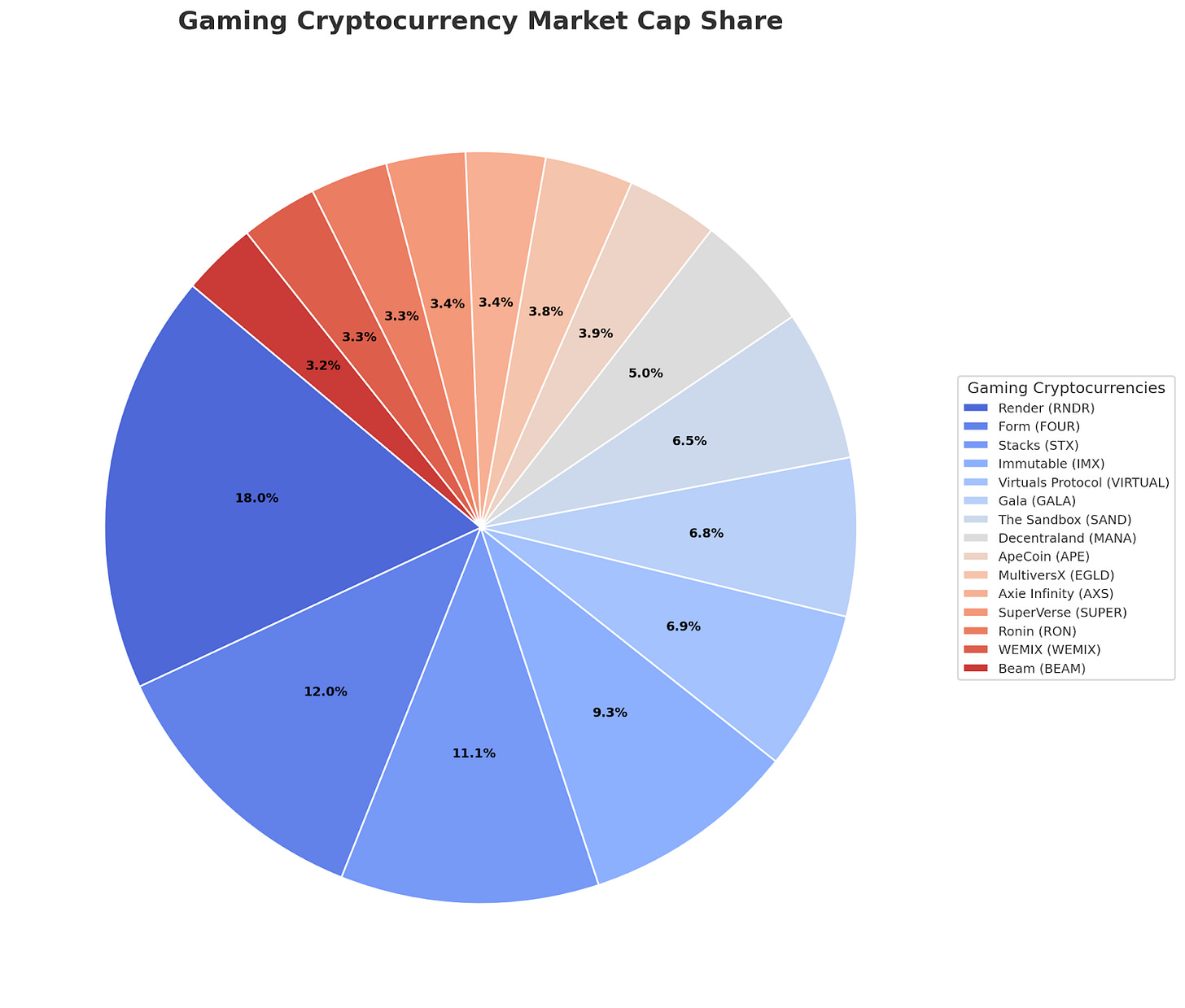

The cryptocurrency market has transformed from a fringe experiment into a multi-trillion-dollar ecosystem, profoundly shaping global finance, technology, and investment paradigms. This comprehensive cheat sheet offers an in-depth overview, spotlighting key statistics, emerging trends, and actionable insights to empower investors and enthusiasts in navigating this dynamic landscape. Drawing on real-time data and expert analyses, we examine the current market state, historical evolution, major trends, inherent risks, and forward-looking projections across key sectors within the cryptocurrency industry. Our coverage encompasses the top 15 cryptocurrencies, stablecoins, Layer 1 protocols, Decentralized Finance (DeFi), Artificial Intelligence (AI) integrations, Real-World Assets (RWA), Gaming, and Decentralized Physical Infrastructure Networks (DePIN). For those seeking simplified exposure, Normal streamlines crypto investing by automating portfolio management. Its Crypto Indexes curate top assets across these sectors, enabling users to harness the long-term potential of the broader crypto industry with ease.

Current Market Snapshot

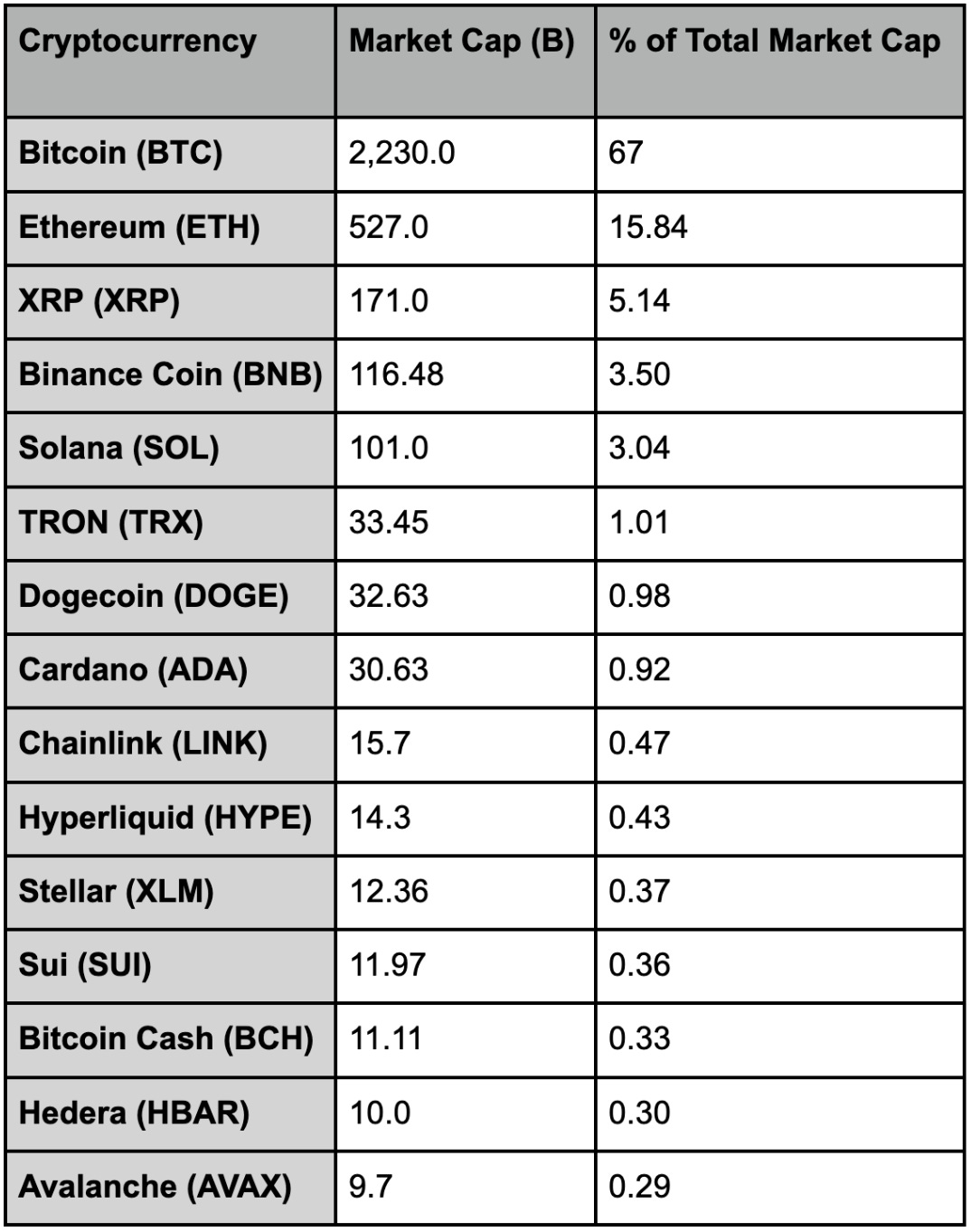

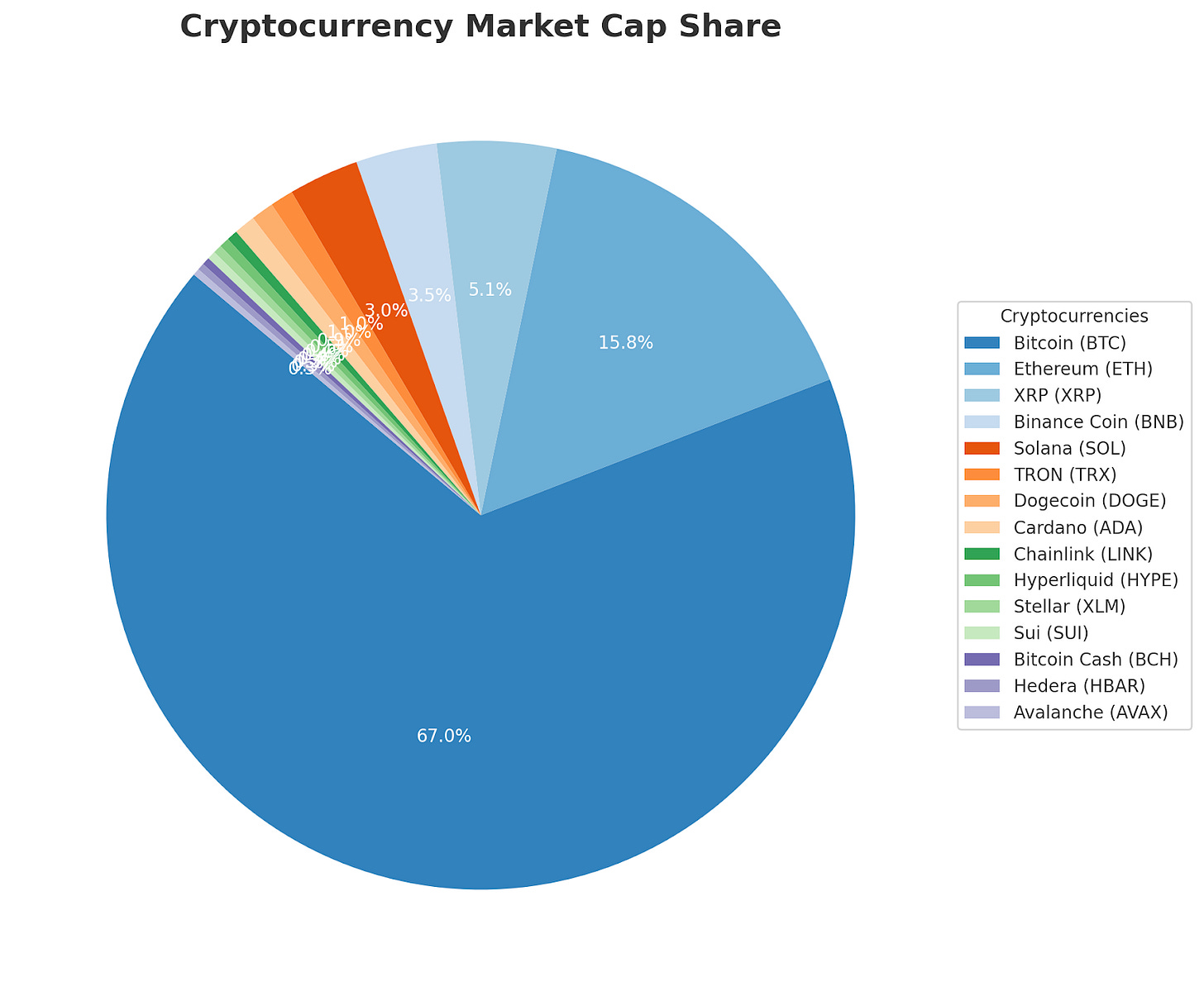

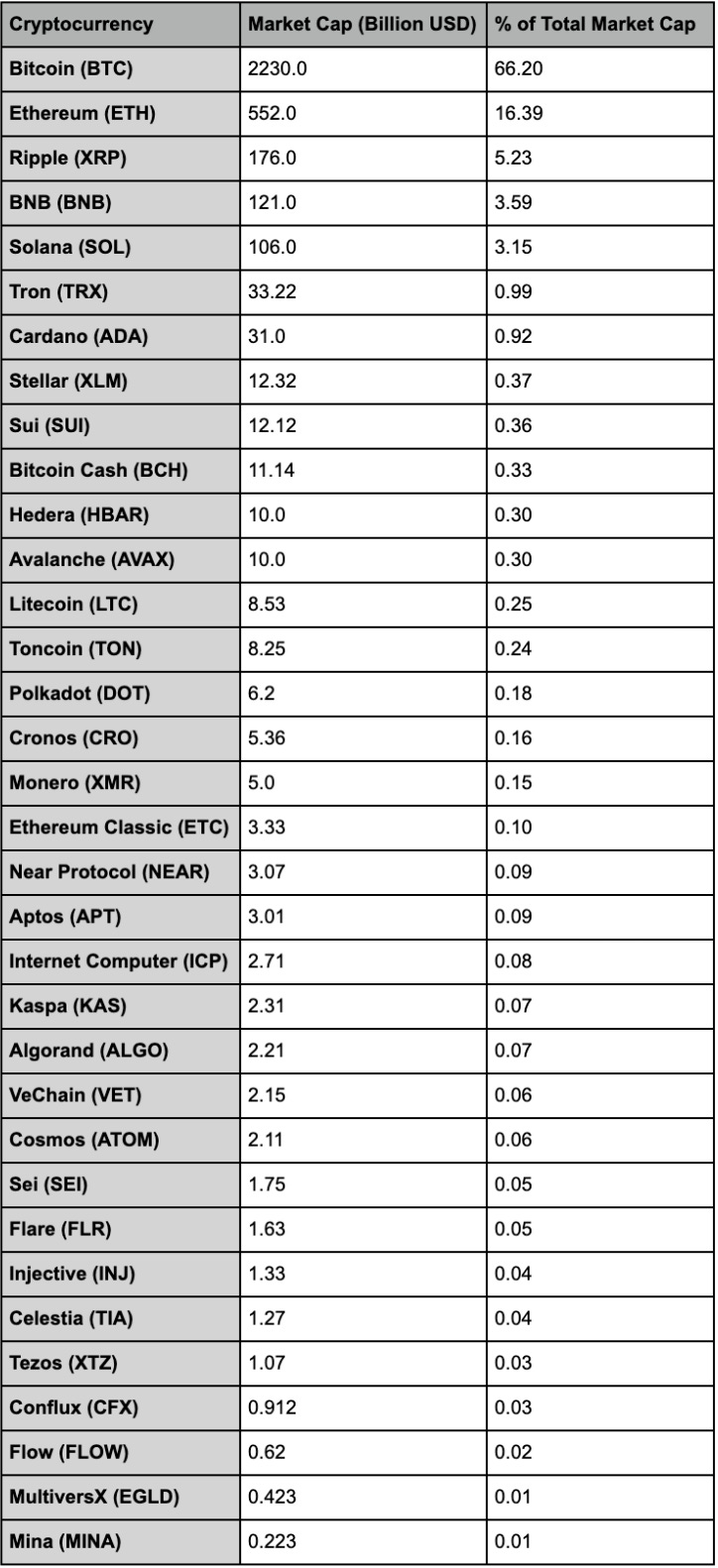

As of August 21, 2025, the global cryptocurrency market capitalization has reached a remarkable milestone of approximately $4 trillion. Bitcoin continues to assert dominance with a 57.5% market share, followed by Ethereum at 13.2%. The 24-hour trading volume surpasses $168 billion, reflecting robust liquidity and fervent market activity. Below is a breakdown of the top 10 cryptocurrencies by market capitalization:

This table highlights the concentration of value in leading assets, with stablecoins like USDT and USDC playing a crucial role in market stability, accounting for over $234 billion in combined market cap.

Historical Context

Cryptocurrencies originated with Bitcoin's inception in 2009, but the market's explosive growth materialized in the 2020s. By late 2024, the total market capitalization peaked at $3.33 trillion in October. Entering 2025, it has eclipsed this record, propelled by institutional adoption and the ripple effects of Bitcoin's April 2024 halving. Historically, halvings catalyze price surges, with heightened search interest and expert forecasts projecting substantial appreciation from 2025 to 2030. Bitcoin's dominance has varied, declining from 64.5% in early July 2025 to 57.5% by mid-August as altcoins, including Ethereum, captured greater share. Today, the ecosystem has matured, encompassing over 2,000 tracked cryptocurrencies and pivoting toward utility-focused innovations.

Key Trends in 2025

2025 marks a phase of consolidation and expansion, with several pivotal trends shaping the market:

Institutional and Regulatory Momentum: Pro-crypto policies, including potential SEC changes and stablecoin regulations like Europe's MiCA, are boosting legitimacy. Institutional moves, such as MicroStrategy's massive Bitcoin purchases and banks embedding blockchain for faster transactions, signal growing adoption. Bitcoin is increasingly viewed as a treasury asset amid global market shifts.

Altcoin and AI Integration Surge: Altcoins are poised for a breakout in August 2025, with signals like technical patterns and fundamental catalysts. The AI-crypto sector has seen explosive growth, adding over $10 billion in market cap in a single week earlier this year, with continued expansion expected. Projects blending AI with blockchain, such as those in DeFi and tokenized assets, are gaining traction.

Stablecoins and DeFi Dominance: Stablecoins represent meaningful utility, with their market cap reaching $280 billion. DeFi volumes hit $34.86 billion in early August, showing resilience amid market volatility. Stablecoins had more volume than Visa and Mastercard in 2024.

Institutional Activity & Regulation

Institutional Adoption

Bitcoin recently surpassed $123,000, fueled by supportive U.S. legislation and surging retail enthusiasm. However, institutional exposure remains modest: less than 5% of spot Bitcoin ETF assets are held by long-term investors like pension funds, while hedge funds and wealth managers account for 10–15%.

Legislation & Strategic Moves

The U.S. has advanced proactive measures, including the establishment of a Strategic Bitcoin Reserve and a Digital Asset Stockpile for seized cryptocurrencies via a March 2025 executive order. In the EU, the Markets in Crypto-Assets Regulation (MiCA) achieved full enforcement by late 2024, clarifying rules for issuers, exchanges, custody, and stablecoins. The U.S. SEC has withdrawn lawsuits against Binance and softened enforcement toward Coinbase in 2025, indicating a regulatory détente. Complementing these, the GENIUS Act of July 2025 provides a holistic oversight framework, while a January White House executive order endorses responsible digital asset and blockchain development.

Future Outlook

Analysts forecast a bull run in late 2025, with Bitcoin potentially reaching $525,000 and Ethereum $22,700 in optimistic scenarios. Blockchain's deeper integration into finance, AI, and real-world assets will likely propel growth through 2030.

Crypto Market Sector Breakdown:

Top 15 Coins:

The top 15 cryptocurrencies by market capitalization, roughly worth 93% of the total crypto market at $3.5 trillion market capitalization. The mission of the Normal Top 15 Index is to capitalize on the appreciation of the most successful cryptocurrencies. Over time, we believe the efficiency of our capital markets will reveal the top 15 most valuable and impactful cryptocurrencies. Investing in these assets is a sound crypto investment strategy.

👉 Total Market Cap (all 15 assets combined): $3.327 trillion

Bitcoin (BTC): Bitcoin, the pioneering cryptocurrency introduced in 2008 by the enigmatic Satoshi Nakamoto, serves as a decentralized digital currency and a store of value, often likened to digital gold. Operating on a proof-of-work consensus mechanism, it enables peer-to-peer transactions without intermediaries, fostering financial sovereignty and resilience against censorship. With a capped supply of 21 million coins, Bitcoin has revolutionized the global economy, inspiring a multitude of blockchain innovations while maintaining its dominance as the most valuable and widely recognized digital asset. BTC trades at approximately $112,065 with a market capitalization of $2.23T. Bitcoin's unparalleled uniqueness lies in its role as the genesis of blockchain technology, featuring a fixed supply cap that enforces scarcity akin to precious metals, coupled with the most robust network security through its immense hash rate. This makes it an ideal hedge against economic uncertainty, with its halving events periodically reducing new supply and historically catalyzing bull markets, solidifying its value as a foundational asset in the digital economy. Official website: https://bitcoin.org

Ethereum (ETH): Ethereum stands as a groundbreaking blockchain platform launched in 2015 by Vitalik Buterin, renowned for introducing smart contracts that automate agreements and enable decentralized applications across finance, gaming, and beyond. Transitioning to a proof-of-stake consensus in 2022, it enhances energy efficiency and scalability, supporting a vibrant ecosystem of tokens and protocols. As the foundational layer for decentralized finance and non-fungible tokens, Ethereum continues to drive innovation, balancing security, programmability, and community governance.ETH trades at approximately $4,336 with a market capitalization of $527B. Ethereum's distinctive value emanates from its pioneering smart contract functionality, which has birthed an expansive ecosystem of dApps and DeFi protocols managing trillions in value, while its upgrade to proof-of-stake has drastically reduced energy consumption by 99.95%, positioning it as a sustainable powerhouse for Web3 innovation and interoperability. Official website: https://ethereum.org

XRP (XRP): XRP, the native token of the XRP Ledger developed by Ripple in 2012, excels in facilitating swift and cost-effective cross-border payments, bridging fiat currencies with unparalleled efficiency. Designed to enhance liquidity for financial institutions, it converts one currency to another seamlessly, bypassing traditional intermediaries. With its consensus protocol ensuring rapid settlements and low fees, XRP empowers global remittances and institutional transfers, embodying a vision of frictionless international finance. XRP trades at approximately $2.88 with a market capitalization of $171B. XRP distinguishes itself through its lightning-fast transaction speeds of under four seconds and negligible fees, making it a premier solution for international money transfers that outpaces traditional systems like SWIFT, while its energy-efficient consensus algorithm consumes minimal power, appealing to environmentally conscious institutions seeking scalable liquidity solutions. Official website: https://xrpl.org

Binance Coin (BNB): Binance Coin, the utility token of the Binance ecosystem since its 2017 inception, streamlines trading on the world's largest cryptocurrency exchange by offering fee discounts and access to exclusive features. Evolving beyond its origins, BNB powers the BNB Chain, enabling staking, governance, and participation in token sales. Through quarterly burns reducing supply, it fosters scarcity and value appreciation, serving as a cornerstone for decentralized applications and financial services within a dynamic global network. BNB trades at approximately $836.26 with a market capitalization of $116.48B. BNB's core uniqueness resides in its integral role within the Binance Smart Chain, providing users with reduced transaction fees and access to a vast array of DeFi and NFT opportunities, bolstered by regular token burns that have decreased supply by over 50% since inception, driving long-term value accrual in one of the most active blockchain ecosystems. Official website: https://www.bnbchain.org

Solana (SOL): Solana, a high-performance blockchain launched in 2020, distinguishes itself with blazing-fast transaction speeds and minimal fees, leveraging proof-of-stake and innovative proof-of-history for unparalleled scalability. Ideal for decentralized applications in gaming, finance, and NFTs, it processes thousands of transactions per second, attracting developers seeking efficiency without compromise. With its native SOL token fueling governance and staking, Solana redefines blockchain potential, prioritizing speed, security, and accessibility in the evolving digital landscape. SOL trades at approximately $180.81 with a market capitalization of $101B. Solana's standout feature is its proof-of-history mechanism, which timestamps transactions to achieve over 65,000 TPS at fractions of a cent, far surpassing competitors, making it the go-to platform for high-frequency applications like decentralized exchanges and gaming, while its robust developer tools foster rapid ecosystem growth. Official website: https://solana.com

TRON (TRX): TRON, founded in 2017 by Justin Sun, emerges as a robust blockchain platform tailored for decentralized entertainment and content sharing, empowering creators with direct ownership through tokenization and dApps. Utilizing delegated proof-of-stake for consensus, it delivers high throughput and low-cost transactions, fostering a global digital economy. With its TRX token enabling payments, staking, and governance, TRON bridges traditional media and blockchain, promoting accessibility and innovation in a creator-centric ecosystem. TRX trades at approximately $0.35 with a market capitalization of $33.45B. TRON's unique proposition is its focus on democratizing content distribution, boasting the largest stablecoin circulation outside Ethereum and high TPS for seamless dApp usage, with its acquisition of BitTorrent integrating billions of users into blockchain-based file sharing and entertainment. Official website: https://tron.network

Dogecoin (DOGE): Dogecoin, born in 2013 as a satirical meme coin featuring the iconic Shiba Inu, has transcended its origins to become a beloved cryptocurrency emphasizing community and tipping culture. Founded by Billy Markus and Jackson Palmer, it operates on a proof-of-work model akin to Litecoin, offering fast transactions and low fees. Boosted by endorsements from figures like Elon Musk, Dogecoin champions charitable causes and viral appeal, blending humor with practical utility in the cryptocurrency realm. DOGE trades at approximately $0.22 with a market capitalization of $32.63B. Dogecoin's charm lies in its community-driven ethos and infinite supply model, which encourages spending and tipping rather than hoarding, coupled with high-profile integrations like Tesla payments, transforming a joke into a culturally significant asset with real-world utility in philanthropy and microtransactions. Official website: https://dogecoin.com

Cardano (ADA): Cardano, a research-driven blockchain platform co-founded in 2015 by Charles Hoskinson, prioritizes sustainability and scalability through its proof-of-stake Ouroboros consensus, enabling secure smart contracts and decentralized finance. Grounded in peer-reviewed academic rigor, it advances interoperability and governance, supporting applications in identity, supply chain, and beyond. With its ADA token facilitating staking and transactions, Cardano embodies a methodical approach to blockchain evolution, fostering inclusive global adoption. ADA trades at approximately $0.86 with a market capitalization of $30.63B. Cardano's distinguishing trait is its rigorous scientific approach, with over 100 peer-reviewed papers backing its protocols, ensuring unparalleled reliability, while its Ouroboros PoS mechanism offers energy efficiency and high staking yields, making it ideal for sustainable, real-world applications in developing regions. Official website: https://cardano.org

Chainlink (LINK): Chainlink, established in 2017 by Sergey Nazarov, revolutionizes blockchain connectivity as a decentralized oracle network, securely bridging smart contracts with real-world data sources. Facilitating tamper-proof information feeds for prices, events, and APIs, it underpins DeFi, NFTs, and insurance protocols with reliable off-chain inputs. Powered by its LINK token for incentives and staking, Chainlink ensures verifiability and resilience, enabling trustless execution in a hybrid on-chain-off-chain framework. LINK trades at approximately $24.90 with a market capitalization of $15.7B. Chainlink's paramount value is its decentralized oracle system, which securely delivers external data to blockchains, enabling trillions in smart contract value across DeFi and beyond, with its Cross-Chain Interoperability Protocol (CCIP) facilitating seamless multi-chain interactions for enhanced security and scalability. Official website: https://chain.link

Hyperliquid (HYPE): Hyperliquid, a cutting-edge decentralized exchange launched in 2022, specializes in perpetual futures trading on its custom Layer-1 blockchain, eliminating gas fees and ensuring transparent on-chain order books. Founded by Harvard alumni Jeff Yan and Iliensinc, it leverages HyperBFT consensus for rapid, secure transactions, appealing to traders with zero-cost efficiency and robust security. Its HYPE token drives governance, staking, and ecosystem rewards, positioning Hyperliquid as a leader in high-performance DeFi. HYPE trades at approximately $43 with a market capitalization of $14.3B. Hyperliquid stands out with its native Layer-1 designed exclusively for derivatives trading, offering sub-second finality and gasless operations, which drastically lowers barriers for high-volume traders, while its on-chain order book transparency prevents front-running, setting a new standard for fair and efficient perpetual markets. Official website: https://hyperliquid.xyz

Stellar (XLM): Stellar, conceived in 2014 by Jed McCaleb, facilitates seamless cross-border payments through its open-source blockchain, connecting financial institutions and individuals with low-cost, rapid transfers. Utilizing the Stellar Consensus Protocol for efficiency and inclusivity, it supports tokenized assets and remittances, bridging traditional finance and digital currencies. Its XLM token powers transactions and anti-spam measures, embodying a mission to democratize global finance with accessibility and transparency. As of August 21, 2025, XLM trades at approximately $0.40 with a market capitalization of $12.36B. Stellar's core innovation is its focus on financial inclusion, enabling instant, near-zero-fee remittances that serve unbanked populations, with built-in asset issuance for tokenizing real-world currencies, making it a vital tool for global NGOs and banks in emerging markets. Official website: https://stellar.org

Sui (SUI): Sui, a permissionless smart contract platform developed by Mysten Labs in 2022, harnesses the Move programming language for high-throughput, low-latency transactions in DeFi, gaming, and beyond. Featuring an object-centric data model and parallel execution, it achieves sub-second finality and horizontal scalability. The SUI token governs the network, pays fees, and enables staking, underscoring Sui's commitment to secure, accessible blockchain innovation. SUI trades at approximately $3.40 with a market capitalization of $11.97B. Sui's revolutionary object-centric model allows for parallel processing of transactions, achieving unprecedented scalability without sharding, making it exceptionally suited for complex applications like gaming and social dApps, while its Move language enhances security against common vulnerabilities. Official website: https://sui.io

Bitcoin Cash (BCH): Bitcoin Cash, emerging from a 2017 fork of Bitcoin, prioritizes scalability with larger blocks up to 32MB, enabling faster, cheaper transactions as peer-to-peer electronic cash. Upholding Satoshi Nakamoto's vision, it employs proof-of-work consensus for security and decentralization, supporting everyday payments and microtransactions. As a continuation of Bitcoin's legacy, BCH fosters global adoption through efficiency and low fees. BCH trades at approximately $558.04 with a market capitalization of $11.11B. Bitcoin Cash's key differentiation is its commitment to on-chain scaling with massive block sizes, facilitating low-cost, high-volume transactions ideal for merchant adoption and daily use, preserving the original vision of Bitcoin as electronic cash in a decentralized manner. Official website: https://bitcoincash.org

Hedera (HBAR): Hedera, powered by hashgraph consensus since 2018, delivers enterprise-grade performance with high-speed, low-cost transactions for applications in finance, supply chains, and beyond. Founded by Leemon Baird and Mance Harmon, it emphasizes security through asynchronous Byzantine fault tolerance and decentralized governance. The HBAR token fuels operations, staking, and micropayments, positioning Hedera as a sustainable alternative to traditional blockchains. HBAR trades at approximately $0.2351 with a market capitalization of $10B. Hedera's hashgraph technology provides superior speed and fairness with 10,000 TPS and carbon-negative certification, making it uniquely positioned for enterprise use cases like tokenized assets and IoT, backed by a governing council of global corporations for trusted stability. Official website: https://hedera.com

Avalanche (AVAX): Avalanche, launched in 2020 by Ava Labs, redefines scalability with its subnet architecture, enabling customizable blockchains for high-throughput applications in DeFi, NFTs, and enterprise solutions. Employing proof-of-stake and multiple virtual machines, it achieves sub-second finality and energy efficiency. The AVAX token secures the network via staking and governance, empowering a flexible, interoperable ecosystem for global adoption. AVAX trades at approximately $22.88 with a market capitalization of $9.7B. Avalanche's subnet structure allows for sovereign, application-specific blockchains that inherit the main network's security, offering infinite scalability and compliance features, ideal for institutional DeFi and gaming, with transaction finality in under a second. Official website: https://avax.network

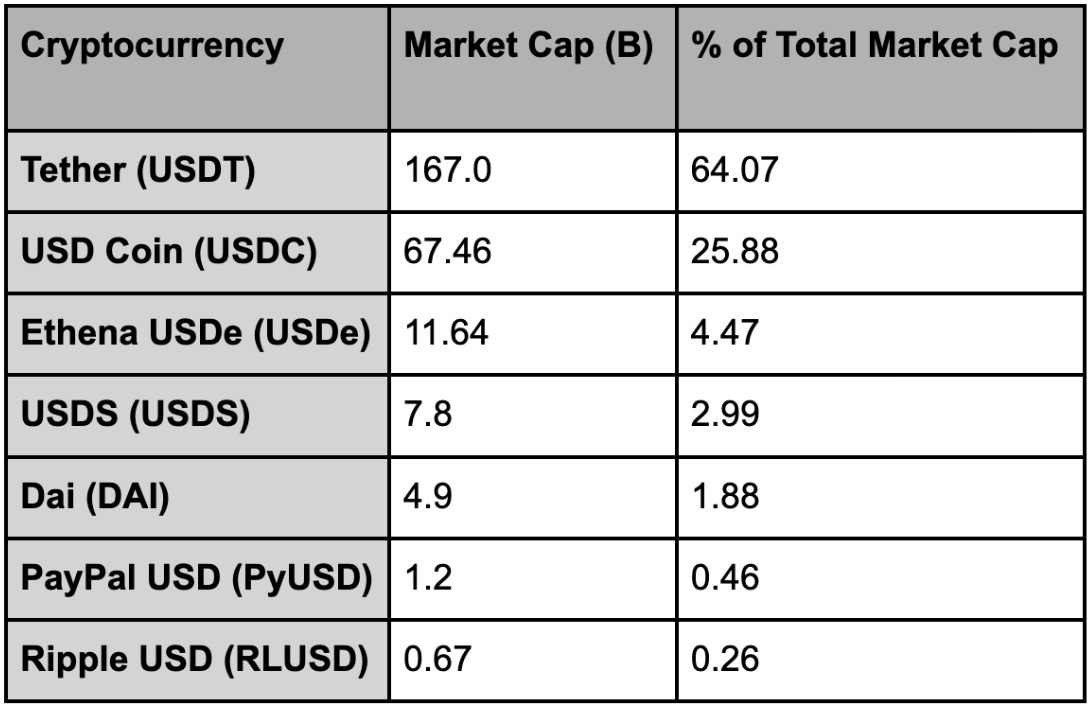

Stablecoins:

Stablecoins have become one of the most critical pillars of the digital asset ecosystem, serving as the bridge between traditional finance and cryptocurrency markets. Pegged to stable assets such as the U.S. dollar, euro, or even commodities, they provide traders and institutions with a reliable medium of exchange, a store of value, and a hedge against volatility. Leading stablecoins like Tether (USDT) and USD Coin (USDC) collectively account for over $200 billion in market capitalization, underpinning a significant share of global crypto trading volume. Their utility extends beyond exchanges, powering decentralized finance (DeFi) protocols, cross-border payments, and remittances, while offering near-instant settlement compared to legacy systems. However, their growth has also drawn heightened regulatory attention, as governments and central banks weigh systemic risks, reserve transparency, and the implications for monetary sovereignty.

👉 Stablecoin Total Market Cap: $260.67B

Tether (USDT): Tether, launched in 2014 by Tether Limited, is the foremost fiat-collateralized stablecoin pegged to the US dollar, providing stability amid cryptocurrency volatility. Backed by reserves including cash equivalents and treasuries, it facilitates seamless trading, remittances, and hedging across exchanges. As the most liquid stablecoin, USDT underpins much of the crypto economy, enabling efficient value transfer while maintaining a 1:1 peg through transparency reports and audits. USDT trades with a market capitalization of $167B. Tether's preeminence stems from its massive liquidity and widespread exchange integration, serving as the de facto dollar in crypto trading with over $100 billion daily volume, while its reserve attestations and expansion to multiple blockchains enhance trust and usability in volatile markets. Official website: https://tether.to

USDC (USDC): USD Coin, introduced in 2018 by Circle and Coinbase, emerges as a regulated stablecoin fully backed by US dollars and equivalents held in segregated accounts. Emphasizing compliance and transparency with monthly attestations, it supports decentralized finance, payments, and cross-border transactions. USDC's integration with traditional finance bridges crypto and fiat, fostering trust and adoption in a secure, auditable framework. USDC trades with a market capitalization of $67.46B.USDC's value is amplified by its full regulatory compliance and monthly audits by top accounting firms, making it a preferred choice for institutions, with seamless redemption to USD and integration into payment systems like Visa, ensuring stability and interoperability across ecosystems. Official website: https://www.circle.com/en/usdc.

Ethena USDe (USDe): Ethena USDe, developed by Ethena Labs in 2024, represents a synthetic stablecoin backed by delta-hedged positions in staked Ethereum and derivatives, offering yield-bearing stability without traditional collateral. Utilizing advanced risk management, it generates returns for holders while maintaining a dollar peg. USDe innovates in DeFi by providing scalable, capital-efficient liquidity, appealing to users seeking passive income alongside stability. USDe trades with a market capitalization of $11.64B. USDe's innovative synthetic design uses hedging strategies to offer yields up to 20% APY on a dollar-pegged asset, revolutionizing stablecoins by decoupling from traditional banking risks, and providing capital-efficient liquidity for DeFi users without over-collateralization. Official website: https://ethena.fi

USDS (USDS): USDS, the stablecoin of the Sky ecosystem (evolving from MakerDAO's framework), is a decentralized, over-collateralized asset pegged to the US dollar, generated through user-locked crypto collateral and governed by community decisions. It prioritizes resilience against market fluctuations via automated stability mechanisms and liquidation processes. USDS embodies the principles of permissionless finance, enabling borrowing, lending, and value preservation in a trustless environment. USDS trades with a market capitalization of $7.8B. USDS's decentralized governance and over-collateralization with diverse assets ensure robustness against volatility, allowing users to mint stable value through smart contracts, with upgrades from MakerDAO enhancing scalability and user sovereignty in permissionless lending. Official website: https://sky.money

Dai (DAI): Dai, created by MakerDAO in 2017, stands as a pioneering decentralized stablecoin maintained through collateralized debt positions and algorithmic adjustments, independent of central authorities. Pegged to the US dollar via community governance and smart contracts, it empowers users in DeFi with borrowing, lending, and trading. Dai's resilience and over-collateralization exemplify blockchain's potential for stable, borderless finance. DAI trades with a market capitalization of $4.9B. Dai's trailblazing decentralization, backed by multi-collateral assets and algorithmic stability fees, allows for censorship-resistant money creation, with billions locked in vaults, making it a cornerstone of DeFi for trustless borrowing and yield farming. Official website: https://makerdao.com

Paypal USD (PyUSD): PayPal USD, launched in 2023 by PayPal in partnership with Paxos, integrates stablecoin technology with mainstream payments, backed 1:1 by US dollar deposits and equivalents. Designed for seamless transfers within the PayPal ecosystem, it enhances digital commerce with low fees and instant settlements. PyUSD bridges fintech and crypto, promoting accessibility and regulatory compliance in everyday transactions. PyUSD trades with a market capitalization of $1.2B. PyUSD's integration with PayPal's 400 million users enables instant, fee-free transfers and merchant payments, backed by full reserves and regulatory oversight, bridging traditional fintech with blockchain for everyday digital dollar usage. Official website: https://www.paypal.com/us/digital-wallet/manage-money/crypto/pyusd.

Ripple USD (RLUSD): Ripple USD, introduced by Ripple in 2024, serves as a dollar-pegged stablecoin on the XRP Ledger and Ethereum, facilitating efficient cross-border payments and liquidity for enterprises. Fully backed by cash and equivalents with regular audits, it leverages Ripple's network for fast, low-cost transfers. RLUSD advances institutional adoption, blending stability with blockchain interoperability for global finance. RLUSD trades with a market capitalization of $670M. RLUSD's enterprise-grade design, with monthly transparency reports and multi-chain compatibility, optimizes liquidity for banks and businesses, enabling sub-second settlements in high-volume corridors, complementing Ripple's payment network for compliant global finance. Official website: https://ripple.com/rlusd.

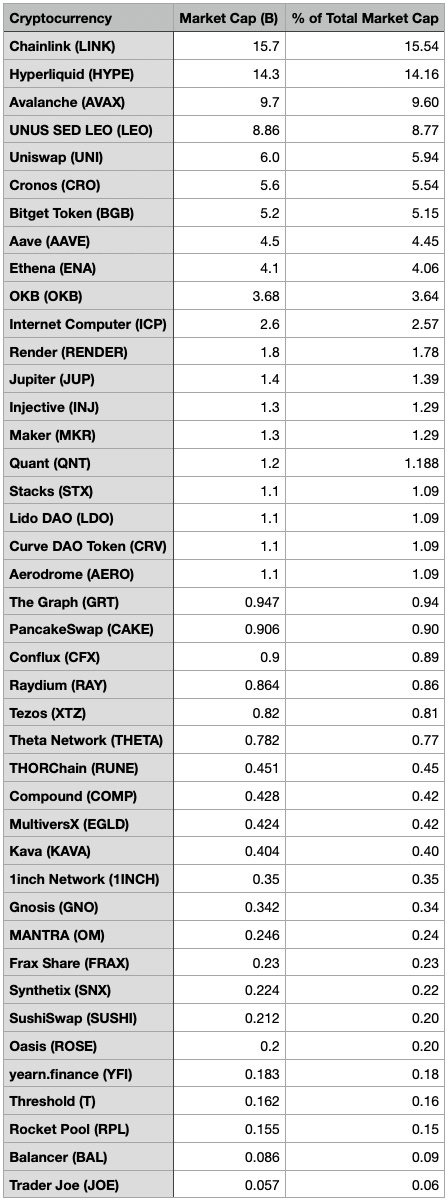

Decentralized Finance (DeFi):

DeFi projects such as lending, staking, swapping, and more. DeFi stands for decentralized finance which is the largest movement within crypto. DeFi seeks to revolutionize our financial markets to make them more fair, accessible, and efficient by connecting us directly with each other rather than going through middle-men institutions. The mission of the Normal DeFi Index is to capitalize on the growth of DeFi as hundreds of billions of dollars flow into it each year. There are many ways to generate returns using DeFi methods such as lending or staking, however, this index only seeks to own the underlying assets for maximum value capture.

👉 Total DeFi Market Cap (these 42 tokens): ~$101.1B

Chainlink (LINK): Chainlink, established in 2017 by Sergey Nazarov, revolutionizes blockchain connectivity as a decentralized oracle network, securely bridging smart contracts with real-world data sources. Facilitating tamper-proof information feeds for prices, events, and APIs, it underpins DeFi, NFTs, and insurance protocols with reliable off-chain inputs. Powered by its LINK token for incentives and staking, Chainlink ensures verifiability and resilience, enabling trustless execution in a hybrid framework. LINK trades at approximately $24.90 with a market capitalization of $15.7B. Chainlink's decentralized oracle system is uniquely vital for feeding accurate real-world data to blockchains, securing over $50 billion in DeFi value, with its CCIP enabling secure cross-chain transfers, reducing risks and unlocking trillions in hybrid smart contract potential. Official website: https://chain.link

Hyperliquid (HYPE): Hyperliquid, a cutting-edge decentralized exchange launched in 2022, specializes in perpetual futures trading on its custom Layer-1 blockchain, eliminating gas fees and ensuring transparent on-chain order books. Founded by Harvard alumni Jeff Yan and Iliensinc, it leverages HyperBFT consensus for rapid, secure transactions, appealing to traders with zero-cost efficiency and robust security. Its HYPE token drives governance, staking, and ecosystem rewards, positioning Hyperliquid as a leader in high-performance DeFi. HYPE trades at approximately $43 with a market capitalization of $14.3B. Hyperliquid's custom Layer-1 for derivatives offers zero-gas perpetuals with on-chain transparency, preventing manipulation and enabling high-leverage trading with sub-second execution, attracting institutional volume in a secure, decentralized manner. Official website: https://hyperliquid.xyz

Avalanche (AVAX): Avalanche, launched in 2020 by Ava Labs, redefines scalability with its subnet architecture, enabling customizable blockchains for high-throughput applications in DeFi, NFTs, and enterprise solutions. Employing proof-of-stake and multiple virtual machines, it achieves sub-second finality and energy efficiency. The AVAX token secures the network via staking and governance, empowering a flexible, interoperable ecosystem for global adoption. AVAX trades at approximately $22.88 with a market capitalization of $9.7B.Avalanche's subnets allow for tailored, sovereign blockchains with shared security, supporting thousands of TPS and custom gas tokens, making it uniquely versatile for private enterprise networks and public DeFi, with low environmental impact. Official website: https://avax.network

UNUS SED LEO (LEO): UNUS SED LEO, launched in 2019 by iFinex, the parent company of Bitfinex, operates as a utility token designed to enhance user benefits across the company’s ecosystem of exchanges and services. Holders enjoy reduced fees on spot and derivatives trading, lending discounts, and access to premium features. LEO trades at approximately $9.60 with a market capitalization of $8.86B. With a buyback-and-burn model funded by iFinex revenues, including recoveries from past events, LEO steadily decreases in circulating supply, cementing its role as both a practical fee-reduction instrument and a value-accruing asset in Bitfinex’s long-term strategy. Official website: https://www.bitfinex.com

Uniswap (UNI): Uniswap, a leading decentralized exchange launched in 2018 by Hayden Adams, revolutionizes trading through automated market-making on Ethereum, enabling permissionless token swaps. Its protocol facilitates liquidity pools, rewarding providers with fees while ensuring efficient price discovery. The UNI token governs the platform, empowering community-driven upgrades and incentivizing participation, solidifying Uniswap’s role as a DeFi cornerstone. UNI trades at approximately $10.72 with a market capitalization of $6B.Uniswap's automated market maker model democratizes liquidity provision, with v3's concentrated liquidity boosting capital efficiency by up to 4000x, making it the largest DEX by volume and a foundational building block for permissionless trading. Official website: https://uniswap.org

Cronos (CRO): Cronos, the native cryptocurrency of the Crypto.com ecosystem, empowers a global suite of financial services spanning trading, payments, lending, and DeFi. Launched in 2018 by Crypto.com, it anchors the Cronos blockchain, an Ethereum Virtual Machine (EVM)-compatible network built on the Cosmos SDK, enabling scalable, low-cost DeFi, NFT, and GameFi applications. CRO fuels transaction fees, staking, and rewards across the ecosystem, while also serving as the backbone for Crypto.com’s Visa card program, offering cashback, rebates, and access to exclusive services. CRO trades at approximately $0.16 with a market capitalization of $5.6B. By bridging centralized exchange services with decentralized applications, Cronos uniquely positions itself as both a consumer-facing brand and a developer-friendly chain, boasting partnerships in sports, gaming, and retail that accelerate mainstream adoption of crypto payments and DeFi. Official website: https://crypto.com

Bitget Token (BGB): Bitget Token, the native asset of the Bitget exchange launched in 2021, underpins the platform’s fast-growing ecosystem of trading, derivatives, and social copy-trading services. BGB powers fee discounts, staking, launchpad participation, and platform governance, while also being integrated into Bitget’s broader Web3 expansion, including wallets and DeFi ventures. BGB trades at approximately $4.58 with a market capitalization of $5.2B. Bitget’s strategic focus on derivatives and copy trading has propelled BGB into one of the fastest-rising exchange tokens, combining user benefits with ambitious ecosystem integration. Official website: https://www.bitget.com

Aave (AAVE): Aave, launched in 2017, is a leading DeFi lending protocol on Ethereum, enabling users to lend and borrow crypto assets via liquidity pools with variable or stable rates. The AAVE token governs protocol upgrades and incentivizes participation, redefining decentralized lending. AAVE trades at approximately $300 with a market capitalization of $4.5B. Aave's flash loans enable uncollateralized borrowing for arbitrage, a feature unique to blockchain that has facilitated billions in instant trades, while its risk management tools and multi-chain deployment enhance safety and accessibility in lending markets. Official website: https://aave.com

Ethena (ENA): Ethena, introduced in 2024, offers a synthetic stablecoin, USDe, backed by delta-hedged Ethereum positions, providing yield-bearing stability for DeFi applications. The ENA token governs the protocol, incentivizing risk management and liquidity provision in a capital-efficient framework. ENA trades at approximately $0.66 with a market capitalization of $4.1B. Ethena's delta-neutral hedging strategy generates sustainable yields on stable assets without banking reliance, disrupting traditional stablecoins by offering high APY and scalability, with ENA tokenholders benefiting from protocol revenue sharing. Official website: https://ethena.fi

OKB (OKB): OKB, issued by OKX (formerly OKEx), functions as a utility and governance token across the exchange’s trading, DeFi, and blockchain services. Launched in 2018, it grants holders discounted fees, access to exclusive features, and participation in OKX Jumpstart token sales. Beyond exchange benefits, OKB fuels OKXChain, the exchange’s scalable public blockchain, powering decentralized apps, cross-chain services, and staking. OKB trades at approximately $175 with a market capitalization of $3.68B. Through its buy-back-and-burn mechanism, OKB reduces supply while reinforcing long-term value, positioning itself as both an exchange utility token and a decentralized ecosystem asset. Official website: https://www.okx.com.

Internet Computer (ICP): Internet Computer, launched in 2021 by DFINITY, aims to decentralize the internet by enabling smart contracts to host full-scale applications, from social media to DeFi, directly on-chain. Utilizing a novel consensus mechanism, it offers scalability and low-cost computation, challenging centralized cloud providers. The ICP token fuels transactions, governance, and staking, fostering a vision of a borderless, secure digital ecosystem. ICP trades at approximately $5.13 with a market capitalization of $2.6B. Internet Computer's chain-key cryptography allows for web-speed dApps hosted entirely on-chain, eliminating cloud dependency and enabling infinite scalability, with ICP's reverse gas model where canisters prepay cycles for user-free interactions. Official website: https://internetcomputer.org

Render (RENDER): Render, launched in 2020, decentralizes GPU computing for rendering graphics, AI, and VR, allowing node operators to monetize unused capacity. The RENDER token facilitates payments and governance, empowering a scalable, decentralized creative economy. RENDER trades at approximately $3.55 with a market capitalization of $1.8B. Render's peer-to-peer GPU marketplace democratizes access to high-power computing, reducing costs by up to 90% compared to centralized providers, with token incentives aligning node operators and users in a growing network for AI and media production. Official website: https://render.network

Jupiter (JUP): Jupiter, a Solana-based decentralized exchange aggregator launched in 2021, optimizes token swaps by routing trades across multiple liquidity pools for minimal slippage and fees. The JUP token governs the platform, fostering community-driven enhancements in DeFi trading efficiency. JUP trades at approximately $0.49 with a market capitalization of $1.4B. Jupiter's aggregation engine scans hundreds of DEXs for optimal routes, saving users on fees and slippage, while its perpetuals and limit orders expand Solana's trading capabilities, making it a one-stop hub for efficient, low-cost swaps. Official website: https://jup.ag

Injective (INJ): Injective, launched in 2018, offers a decentralized exchange protocol for cross-chain derivatives trading, leveraging Cosmos SDK for instant, low-cost transactions. Supporting futures, margin trading, and interoperability with Ethereum and Solana, it empowers traders with advanced tools. The INJ token governs and incentivizes participation in this high-performance DeFi ecosystem. INJ trades at approximately $12.77 with a market capitalization of $1.3B. Injective's Layer-1 optimized for finance enables permissionless listing of markets, with zero-gas derivatives and cross-chain bridging, attracting institutional traders with advanced order types and interoperability across major ecosystems. Official website: https://injective.com

Maker (MKR): Maker, introduced in 2017 by MakerDAO, powers the decentralized stablecoin Dai through over-collateralized lending and smart contracts on Ethereum. Its governance token, MKR, enables community-driven decisions on protocol parameters, ensuring stability and transparency. Maker’s innovative approach to DeFi underpins a resilient, decentralized financial system. MKR trades at approximately $1,637 with a market capitalization of $1.3B. Maker's governance model burns MKR tokens from fees, creating deflationary pressure, while its multi-collateral Dai system has maintained peg through extreme volatility, serving as a pillar for DeFi with billions in locked value. Official website: https://makerdao.com

Quant (QNT): Quant, founded in 2018, enables blockchain interoperability through its Overledger network, connecting disparate chains for seamless data and asset transfers. The QNT token facilitates access, licensing, and governance, supporting enterprise and DeFi cross-chain solutions. QNT trades at approximately $106 with a market capitalization of $1.2B. Quant's Overledger OS acts as a universal API for blockchains, enabling multi-ledger tokens and secure enterprise integrations, solving fragmentation and unlocking trillions in locked value across isolated networks. Official website: https://www.quant.network

Stacks (STX): Stacks, launched in 2018, extends Bitcoin’s functionality by enabling smart contracts and dApps that leverage Bitcoin’s security via proof-of-transfer consensus. Bridging DeFi and NFTs to Bitcoin’s ecosystem, it allows users to earn BTC rewards through stacking. The STX token facilitates transactions and governance, unlocking new possibilities for decentralized applications on Bitcoin’s foundation. STX trades at approximately $0.66 with a market capitalization of $1.1B.Stacks uniquely anchors to Bitcoin's security, allowing users to stack STX to earn BTC yields, bringing smart contracts to the most secure blockchain without forking, ideal for Bitcoin-native DeFi and assets. Official website: https://stacks.co

Lido DAO (LDO): Lido DAO, launched in 2020, pioneers liquid staking, allowing users to stake Ethereum and other assets while retaining liquidity for DeFi applications. Governed by the LDO token, it ensures decentralized management and incentivizes participation, bridging staking with DeFi’s flexibility. LDO trades at approximately $1.27 with a market capitalization of $1.1B. Lido's liquid staking tokens (like stETH) represent staked assets usable in DeFi, boosting capital efficiency and network security, with over 30% of Ethereum staked through it, democratizing participation without lockups. Official website: https://lido.fi

Curve DAO Token (CRV): Curve, launched in 2020, specializes in low-slippage stablecoin swaps through automated market makers, optimizing DeFi liquidity pools. The CRV token governs the protocol and incentivizes liquidity providers, ensuring efficient stable asset trading. CRV trades at approximately $0.87 with a market capitalization of $1.1B. Curve's specialized AMM curves minimize impermanent loss for stable assets, handling billions in volume with minimal slippage, and its vote-escrow mechanism rewards long-term liquidity providers with boosted yields. Official website: https://curve.fi

Aerodrome (AERO): Aerodrome, a decentralized exchange on the Base blockchain launched in 2023, enhances liquidity provision through concentrated liquidity pools, optimizing capital efficiency for DeFi traders. The AERO token governs and incentivizes participation, driving a robust trading ecosystem. AERO trades at approximately $1.30 with a market capitalization of $1.1B.Aerodrome's ve(3,3) model combines vote-escrow with emissions, maximizing incentives for liquidity providers on Base, resulting in high TVL growth and efficient trading in the Optimism superchain ecosystem. Official website: https://aerodrome.finance

The Graph (GRT): The Graph, launched in 2020, serves as a decentralized indexing protocol, enabling efficient querying of blockchain data for dApps in DeFi and beyond. Known as the “Google of blockchain,” it organizes data via subgraphs, supporting ecosystems like Ethereum and Solana. The GRT token incentivizes curators and indexers, driving a decentralized data economy. GRT trades at approximately $0.09 with a market capitalization of $947M.The Graph's subgraph system indexes blockchain data for fast queries, powering thousands of dApps with decentralized, censorship-resistant access, reducing reliance on centralized APIs and enabling Web3's data layer. Official website: https://thegraph.com

PancakeSwap (CAKE): PancakeSwap, a leading decentralized exchange on BNB Chain since 2020, offers low-cost token swaps and yield farming through automated market makers. The CAKE token incentivizes liquidity provision and governs protocol upgrades, driving accessible DeFi solutions. CAKE trades at approximately $2.63 with a market capitalization of $906M. PancakeSwap's multi-chain expansion and lottery features add gamification to DeFi, with CAKE's deflationary burns and farming rewards creating high APYs, making it the top DEX on BNB Chain for retail users. Official website: https://pancakeswap.finance

Conflux (CFX): Conflux, launched in 2020, is a high-throughput Layer-1 blockchain using a tree-graph consensus for parallel transaction processing, ideal for DeFi and dApps. The CFX token supports fees, staking, and governance, driving scalability in Asia-focused blockchain ecosystems. CFX trades at approximately $0.175 with a market capitalization of $900M. Conflux's tree-graph structure allows for 3,000 TPS without sharding, bridging China and global markets with regulatory-friendly features, fostering adoption in gaming and DeFi in Asia. Official website: https://confluxnetwork.org

Raydium (RAY): Raydium, a Solana-based decentralized exchange launched in 2021, combines automated market makers with a central limit order book for efficient token swaps. The RAY token incentivizes liquidity provision and governance, enhancing DeFi trading on Solana’s high-speed network. RAY trades at approximately $3.22 with a market capitalization of $864M. Raydium's hybrid AMM-order book model on Solana provides serum liquidity for low-slippage trades, with launchpad features for new tokens, making it a hub for early projects and high-speed trading. Official website: https://raydium.io

Tezos (XTZ): Tezos, launched in 2018, is a self-upgrading blockchain using proof-of-stake and formal verification for secure smart contracts in DeFi and NFTs. Its on-chain governance, driven by the XTZ token, ensures adaptability and community consensus, fostering long-term resilience. XTZ trades at approximately $0.80 with a market capitalization of $820M. Tezos's self-amending mechanism allows seamless upgrades without hard forks, with formal verification minimizing bugs, attracting artists and enterprises for sustainable, evolving blockchain applications. Official website: https://tezos.com

Theta Network (THETA): Theta Network, founded in 2018, redefines video streaming through a decentralized protocol, leveraging peer-to-peer bandwidth sharing to reduce costs and enhance quality. Its dual-token system, with THETA for governance and staking, supports a creator-centric ecosystem for content delivery and NFTs. THETA trades at approximately $0.78 with a market capitalization of $782M. Theta's edge node network offloads 80% of CDN costs by crowdsourcing bandwidth, with AI-optimized delivery and partnerships with Google Cloud, revolutionizing streaming for lower latency and higher earnings for viewers. Official website: https://www.thetatoken.org

THORChain (RUNE): THORChain, launched in 2019, facilitates cross-chain liquidity through decentralized swaps across blockchains like Bitcoin and Ethereum, using an automated market maker model. Its RUNE token incentivizes liquidity provision and governance, ensuring secure, trustless asset exchanges. THORChain’s interoperability drives seamless DeFi integration. RUNE trades at approximately $1.28 with a market capitalization of $451M. THORChain's continuous liquidity pools enable non-custodial cross-chain swaps without wrapped assets, with RUNE bonding ensuring economic security against attacks, bridging silos in a trustless manner. Official website: https://thorchain.org

Compound (COMP): Compound, launched in 2018, is a DeFi lending protocol on Ethereum, enabling users to lend and borrow assets algorithmically with dynamic interest rates. The COMP token governs the protocol and distributes rewards, shaping decentralized lending innovation. COMP trades at approximately $45.35 with a market capitalization of $428M. Compound's algorithmic interest rates adjust in real-time based on supply/demand, with cTokens accruing value automatically, pioneering money markets that have inspired the DeFi lending boom. Official website: https://compound.finance

MultiversX (EGLD): MultiversX, formerly Elrond, launched in 2020, offers a sharded Layer-1 blockchain for high-speed, low-cost transactions in DeFi, NFTs, and gaming. Its adaptive state sharding and secure proof-of-stake ensure scalability, with EGLD powering fees and staking. EGLD trades at approximately $14.84 with a market capitalization of $424M. MultiversX's adaptive sharding achieves 100,000 TPS with low energy use, with built-in DeFi tools like Maiar DEX, making it a high-performance platform for metaverse and enterprise applications. Official website: https://multiversx.com

Kava (KAVA): Kava, launched in 2019, is a cross-chain DeFi platform enabling lending, borrowing, and stablecoin issuance, integrating assets from Cosmos, Ethereum, and more. The KAVA token secures the network and governs decisions, promoting interoperable financial services. KAVA trades at approximately $0.37 with a market capitalization of $404M. Kava's co-chain architecture bridges Cosmos and Ethereum, allowing USDX minting with diverse collateral, providing high-yield opportunities in a secure, interoperable DeFi hub. Official website: https://www.kava.io

1inch Network (1INCH): 1inch Network, launched in 2020, is a DeFi aggregator optimizing token swaps across multiple decentralized exchanges for the best rates. The 1INCH token governs the protocol and incentivizes participation, streamlining trading efficiency in DeFi. 1INCH trades at approximately $0.25 with a market capitalization of $350M. 1inch's pathfinder algorithm splits trades across DEXs for optimal pricing, saving users on gas and slippage, with Chi gas tokens further reducing costs in volatile markets. Official website: https://1inch.io

Gnosis (GNO): Gnosis, founded in 2015, supports decentralized infrastructure through prediction markets, safe wallets, and a sidechain for low-cost DeFi transactions. The GNO token governs the ecosystem and incentivizes staking, fostering secure, user-driven financial tools. GNO trades at approximately $130 with a market capitalization of $342M. Gnosis's prediction markets enable accurate forecasting with real stakes, while its Safe multi-sig wallet secures billions, and Owl token mechanics reward long-term holders with ecosystem fees. Official website: https://www.gnosis.io

MANTRA (OM): MANTRA, launched in 2020, offers a Layer-1 blockchain for tokenized real-world assets and DeFi, focusing on regulatory compliance and interoperability. The OM token drives governance, staking, and fees, fostering a secure bridge between traditional and decentralized finance.OM trades at approximately $0.24 with a market capitalization of $246M. MANTRA's compliance modules enable regulated RWA tokenization, with IBC interoperability connecting Cosmos chains, positioning it as a gateway for institutions entering DeFi with legal safeguards. Official website: https://mantraomniverse.com.

Frax Share (FRAX): Frax, launched in 2020, supports a fractional-algorithmic stablecoin protocol, blending collateral and algorithmic mechanisms for stability. The FRAX token governs the ecosystem and captures value from protocol fees, driving innovation in stablecoin design. FRAX trades at approximately $2.56 with a market capitalization of $230M. Frax's hybrid algorithm adjusts collateral ratios dynamically for capital efficiency, with FRAX stablecoin maintaining peg through arbitrage incentives, offering a scalable alternative to fully collateralized models. Official website: https://frax.finance

Synthetix (SNX): Synthetix, launched in 2018, enables the creation of synthetic assets on Ethereum, allowing users to gain exposure to diverse assets via tokenized derivatives. The SNX token collateralizes the system and governs protocol upgrades, powering a versatile DeFi derivatives market. SNX trades at approximately $0.65 with a market capitalization of $224M. Synthetix's infinite liquidity for synths tracks real-world assets like stocks and commodities without counterparties, with SNX stakers earning fees while backing the system, expanding DeFi's reach to traditional markets. Official website: https://synthetix.io

SushiSwap (SUSHI): SushiSwap, a decentralized exchange forked from Uniswap in 2020, enhances DeFi trading with automated market makers and yield farming on Ethereum and other chains. The SUSHI token incentivizes liquidity provision and governs protocol upgrades, fostering community-driven DeFi innovation. SUSHI trades at approximately $0.77 with a market capitalization of $212M. SushiSwap's Onsen farming program and BentoBox lending vault optimize yields, with community governance ensuring fair token distribution, making it a vibrant, user-owned alternative in the DEX landscape. Official website: https://www.sushi.com

Oasis (ROSE): Oasis, launched in 2020, prioritizes privacy and scalability in DeFi through confidential smart contracts and a layered architecture. The ROSE token powers transactions, staking, and governance, enabling secure data processing for private DeFi applications.ROSE trades at approximately $0.027 with a market capitalization of $200M. Oasis's Sapphire para-chain supports confidential computing, allowing private DeFi transactions and data, bridging privacy with Ethereum compatibility for sensitive applications like healthcare and finance. Official website: https://oasisprotocol.org

yearn.finance (YFI): yearn.finance, launched in 2020 by Andre Cronje, automates yield farming by optimizing returns across DeFi protocols through algorithmic vaults. The YFI token governs the platform, enabling community control and incentivizing participation in a dynamic yield ecosystem. YFI trades at approximately $5,437 with a market capitalization of $183M. Yearn's vaults automatically shift funds to highest-yield opportunities, saving users time and gas, with YFI's fair launch (no pre-mine) embodying DeFi's ethos and capturing protocol value for holders. Official website: https://yearn.finance

Threshold (T): Threshold, formed in 2022 from the merger of Keep and NuCypher, provides decentralized key management and encryption for privacy-focused DeFi applications. The T token governs the network and incentivizes node operators, ensuring secure data handling. T trades at approximately $0.016 with a market capitalization of $162M. Threshold's tBTC allows trustless Bitcoin wrapping for DeFi, using threshold cryptography to distribute keys, enhancing security and enabling cross-chain utility without centralized custodians. Official website: https://threshold.network

Rocket Pool (RPL): Rocket Pool, launched in 2021, offers decentralized Ethereum staking with liquid tokens, enabling users to stake with lower barriers while maintaining liquidity. The RPL token governs the protocol and collateralizes node operators, enhancing staking accessibility. RPL trades at approximately $7.18 with a market capitalization of $155M. Rocket Pool lowers the 32 ETH staking threshold to 0.01 ETH via pooled nodes, with rETH tokens accruing rewards while tradable, decentralizing Ethereum's validator set for greater network health. Official website: https://rocketpool.net

Balancer (BAL): Balancer, launched in 2020, is a decentralized exchange and liquidity protocol on Ethereum, allowing flexible, multi-asset pools for efficient trading and yield generation. The BAL token governs the protocol and rewards liquidity providers, enhancing DeFi’s capital efficiency. BAL trades at approximately $1.29 with a market capitalization of $86 million. Balancer's weighted pools allow up to 8 assets with custom allocations, optimizing for index-like funds and automated rebalancing, providing superior capital efficiency over traditional AMMs. Official website: https://balancer.fi

JOE (JOE): JOE, the native token of Trader Joe, a decentralized exchange on Avalanche launched in 2021, facilitates trading, lending, and yield farming with low fees and high speed. JOE governs the platform and incentivizes liquidity, driving a vibrant DeFi ecosystem on Avalanche. JOE trades at approximately $0.14 with a market capitalization of $57 million. Trader Joe's Zap feature enables single-transaction LP creation, with JOE's revenue-sharing for veJOE holders, making it a community-focused DEX with integrated lending on Avalanche's fast network. Official website: https://traderjoexyz.com

Artificial Intelligence (AI):

The most successful artificial intelligence and data availability blockchain projects. AI projects integrate crypto in a variety of ways including payment economics for computation, distributed voting, and more. Data availability projects focus primarily on ensuring decentralized, uncensored access to valuable data sources such as asset prices, important internet components like DNS servers, and supply chain information. The mission of the Normal AI/Data Index is to provide reliable exposure to the fast-growing AI sector and its overlap with crypto. Keeping track of new projects, and more importantly which ones provide the most long-term value, is difficult. This index seeks to simplify investing in this sector of crypto as things change quickly.

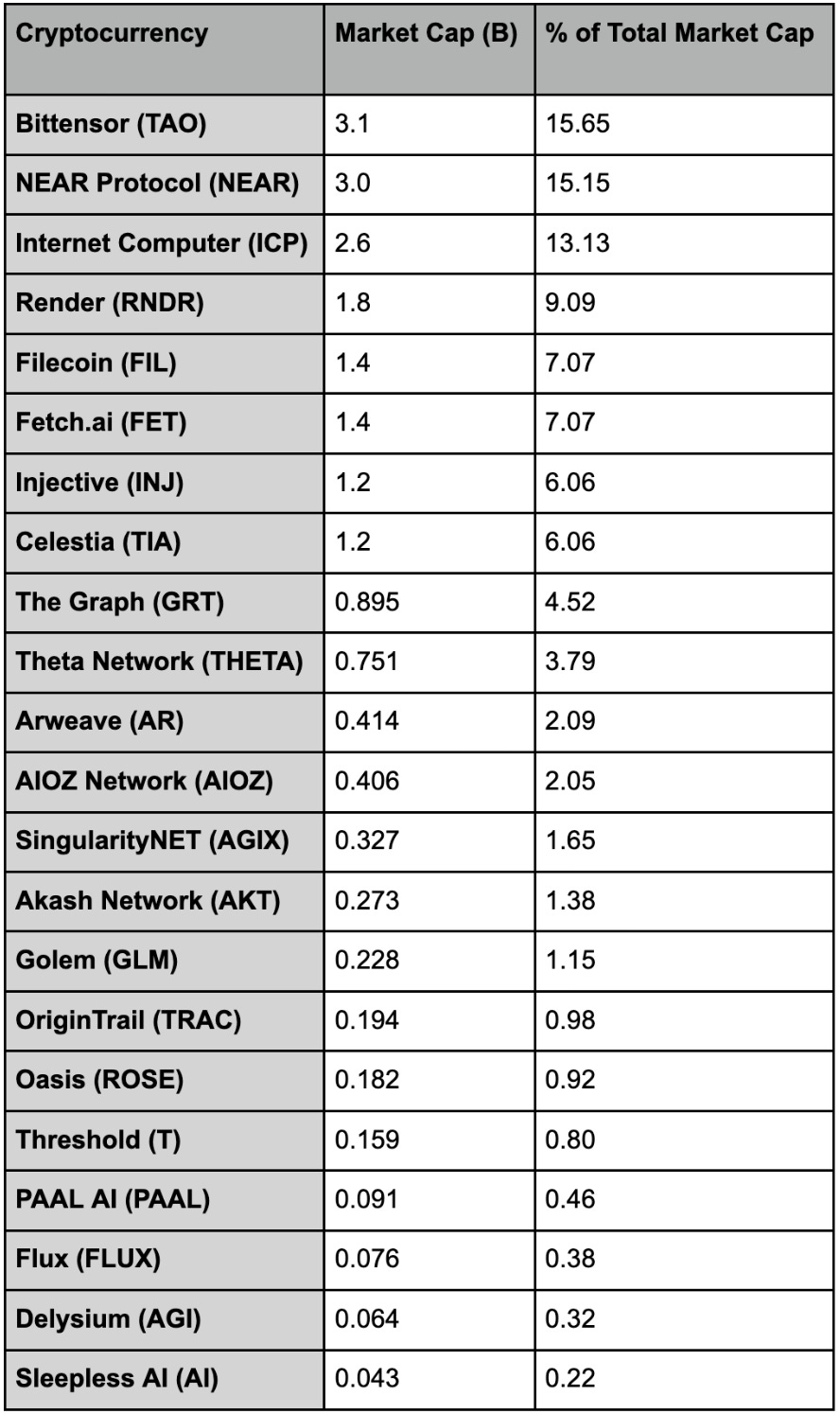

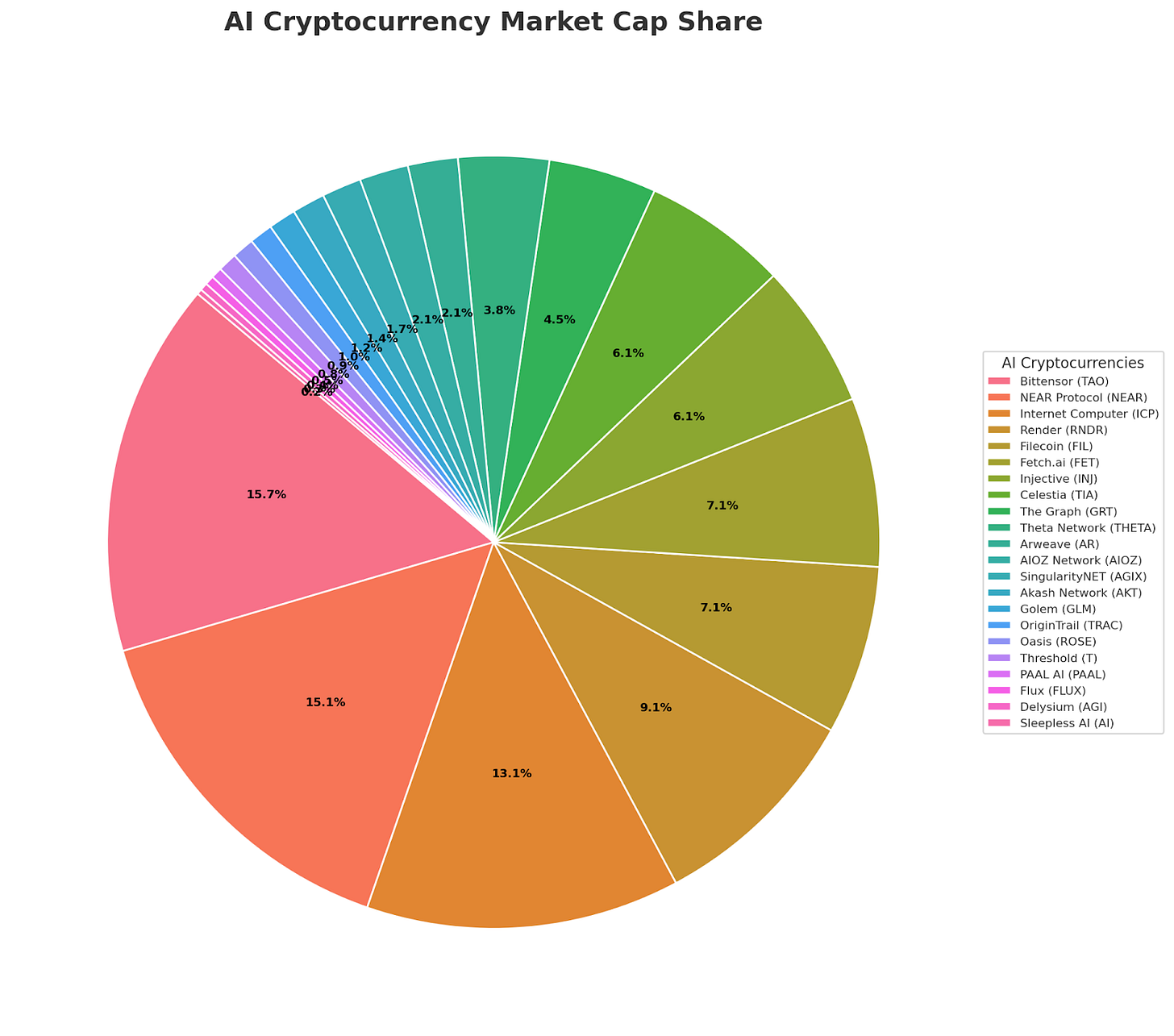

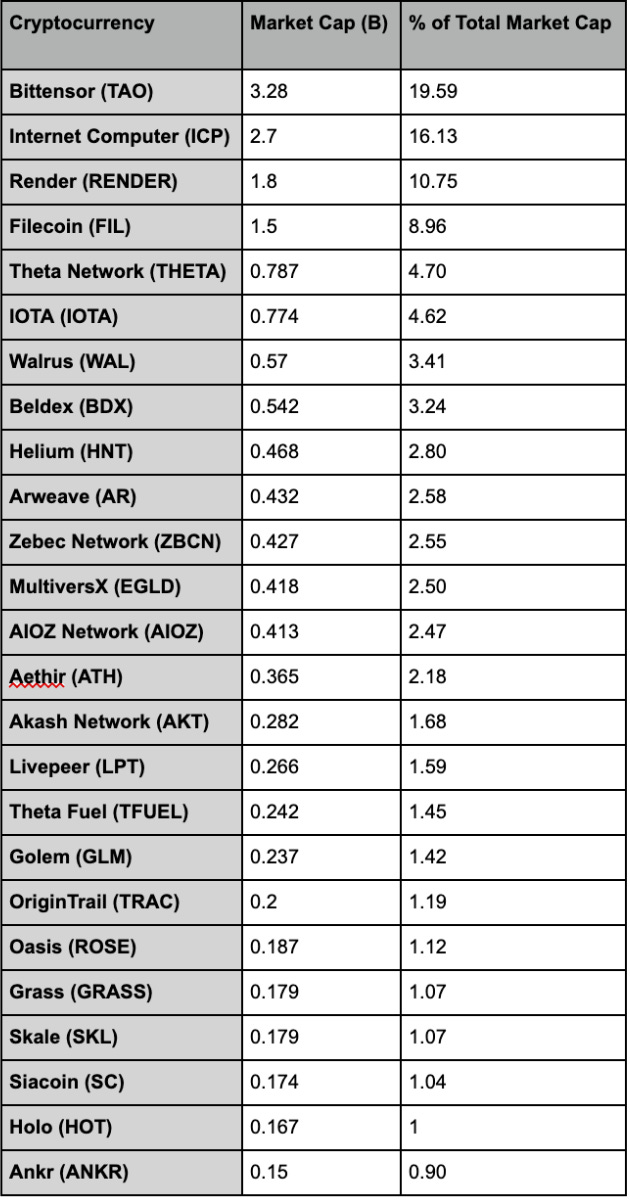

👉 Total Market Cap of these AI tokens: ≈ $19.8B

NEAR Protocol (NEAR): NEAR Protocol, launched in 2020 by the NEAR Collective, is a scalable Layer-1 blockchain designed for user-friendly decentralized applications (dApps), leveraging dynamic sharding and proof-of-stake for high-speed, low-cost transactions. Its AI-native infrastructure enables autonomous agents to transact and coordinate across blockchains, supporting use cases in DeFi and cross-chain asset movement. The NEAR token powers transactions, staking, and governance, fostering a vibrant ecosystem for AI-driven innovation. NEAR trades at approximately $2.40 with a market capitalization of $3B. NEAR's Nightshade sharding and account abstraction make it developer-friendly for AI agents, with low fees and fast finality, positioning it as a hub for AI-blockchain fusion in autonomous economies. Official website: https://near.org

Internet Computer (ICP): Internet Computer, launched in 2021 by DFINITY, reimagines blockchain as a global virtual computer, enabling end-to-end decentralized applications like social media and DeFi without reliance on traditional cloud services. Using advanced cryptography and a unique consensus model, it supports AI-driven dApps with high scalability. The ICP token facilitates transactions, governance, and staking, driving a decentralized internet vision. ICP trades at approximately $4.87 with a market capitalization of $2.6B. ICP's canister smart contracts run at web speed with unlimited capacity, enabling on-chain AI models and data, challenging centralized clouds like AWS with sovereign, tamper-proof computing. Official website: https://internetcomputer.org

Render (RNDR): Render, launched in 2020, decentralizes GPU computing for rendering graphics, AI, and VR, allowing node operators to monetize unused capacity. Its intuitive tools streamline rendering processes, enhancing efficiency for creators. The RNDR token facilitates payments and governance, powering a decentralized creative economy. RNDR trades at approximately $3.52 with a market capitalization of $1.8B. Render's OTOY integration provides Hollywood-grade rendering via distributed GPUs, cutting costs for AI training and visuals, with token economics rewarding node contributions in a growing metaverse economy. Official website: https://render.network

Filecoin (FIL): Filecoin, launched in 2020, is a decentralized storage network enabling secure, peer-to-peer data storage, competing with centralized cloud providers like AWS. While not exclusively AI-focused, it supports AI datasets through integration with IPFS, ensuring transparency and accessibility. The FIL token incentivizes storage providers and governs the network, democratizing data storage. FIL trades at approximately $2.16 with a market capitalization of $1.4B. Filecoin's proof-of-replication and spacetime ensures verifiable storage, with deals for AI data sets offering cheaper, censorship-resistant alternatives to centralized clouds, powering Web3's data layer. Official website: https://filecoin.io

The Graph (GRT): The Graph, launched in 2018, is a decentralized indexing protocol that organizes blockchain data using GraphQL, making it accessible for dApps in DeFi and AI. Known as the “Google of blockchain,” it enables efficient querying via subgraphs. The GRT token incentivizes indexers, curators, and delegators, driving a decentralized data economy. GRT trades at approximately $0.086 with a market capitalization of $895M. The Graph's subgraphs index complex data for quick queries, supporting AI analytics on-chain, with curated marketplaces ensuring high-quality data for dApps across multiple blockchains. Official website: https://thegraph.com

Arweave (AR): Arweave, launched in 2018, offers permanent, decentralized data storage through its “blockweave” structure, ensuring data permanence with a one-time fee. Its Permaweb hosts immutable applications, ideal for AI datasets. The AR token pays for storage and incentivizes miners, supported by partnerships with Microsoft and IBM. AR trades at approximately $6.30 with a market capitalization of $414M. Arweave's endowments fund perpetual storage, making it perfect for AI models and NFTs that require immutability, with Succinct Proofs of Random Access verifying data without redownloading. Official website: https://arweave.org

Bittensor (TAO): Bittensor, launched in 2021, creates a decentralized AI marketplace where machine learning models collaborate and are rewarded based on value contribution. Dubbed the “Bitcoin for AI,” its TAO token incentivizes developers, pays fees, and enables governance, fostering transparent AI innovation. TAO trades at approximately $317 with a market capitalization of $3.1B.Bittensor's peer-reviewed AI subnet system rewards models for intelligence, creating a collaborative network that democratizes AI development, with TAO as the currency for compute and knowledge sharing. Official website: https://bittensor.com

Injective (INJ): Injective, launched in 2018, is a Layer-1 blockchain and decentralized exchange protocol enabling cross-chain trading of cryptocurrencies and derivatives. Its AI-driven features support algorithmic trading and prediction markets. The INJ token governs, stakes, and burns fees to reduce supply, enhancing DeFi interoperability. INJ trades at approximately $12.79 with a market capitalization of $1.2B. Injective's on-chain order book for derivatives integrates AI for market prediction, with fee burns creating deflation, offering advanced tools for traders in a fully decentralized environment. Official website: https://injective.com

Theta Network (THETA): Theta Network, launched in 2018, decentralizes video streaming and computing through peer-to-peer bandwidth sharing, optimizing delivery with AI-driven caching. Supported by partners like Samsung, it uses THETA for governance and staking, enhancing content ecosystems. THETA trades at approximately $0.75 with a market capitalization of $751M. Theta's AI caching predicts viewer demand for smoother streaming, reducing costs by 50%, with dual tokens enabling viewer rewards and edge compute for AI tasks in a decentralized CDN. Official website: https://www.thetatoken.org

Fetch.ai (FET): Fetch.ai, launched in 2018, builds a decentralized AI economy with autonomous agents for trading, energy, and IoT applications. Merged into the Artificial Superintelligence Alliance, its FET token (transitioning to ASI) powers transactions, staking, and governance, competing with Big Tech’s AI dominance. FET trades at approximately $0.62 with a market capitalization of $1.4B. Fetch.ai's autonomous economic agents negotiate and execute tasks independently, merging with Ocean and SingularityNET to form ASI, creating a superintelligent network for decentralized AI services. Official website: https://fetch.ai

Celestia (TIA): Celestia, launched in 2023, is the first modular blockchain, separating data availability, consensus, and execution for scalable AI and DeFi applications. Its TIA token secures the network, pays for data availability, and enables governance, pioneering modular blockchain architecture. TIA trades at approximately $1.59 with a market capitalization of $1.2B. Celestia's data availability sampling allows light nodes to verify massive data, enabling rollups to scale without full nodes, revolutionizing blockchain modularity for AI compute layers. Official website: https://celestia.org

Akash Network (AKT): Akash Network, launched in 2018, is an open-source decentralized cloud computing platform, offering GPU access for AI workloads as an alternative to AWS. Its AKT token facilitates governance, security, and payments, with partnerships like Coinbase Prime enhancing its reach. AKT trades at approximately $1.09 with a market capitalization of $273M. Akash's reverse auction marketplace for cloud resources cuts costs by 85%, with GPU support for AI training, empowering developers with sovereign, censorship-resistant compute. Official website: https://akash.network

SingularityNET (AGIX): SingularityNET, launched in 2017, is a decentralized marketplace for AI services, enabling developers to share algorithms and models. Transitioning to the ASI token post-merger with Fetch.ai and Ocean Protocol, AGIX supports governance and payments, fostering a global AI ecosystem. AGIX trades at approximately $0.27 with a market capitalization of $327M. SingularityNET's marketplace allows AI agents to request and provide services autonomously, with the ASI merger creating a unified token for superintelligent, decentralized AI collaboration. Official website: https://singularitynet.io

AIOZ Network (AIOZ): AIOZ Network, a Layer-1 blockchain, optimizes decentralized AI, storage, and streaming, leveraging its W3AI framework for accessible AI training. The AIOZ token powers transactions, staking, and node rewards, bridging Ethereum and Cosmos ecosystems. AIOZ trades at approximately $0.33 with a market capitalization of $406M. AIOZ's dCDN uses AI to optimize content delivery, rewarding nodes for bandwidth and compute, providing a greener alternative for streaming and AI with cross-chain bridges. Official website: https://aioz.network

Theta Fuel (TFUEL): Theta Fuel, the operational token of Theta Network, facilitates micropayments and transactions for video streaming and smart contracts. Complementing the THETA governance token, TFUEL supports AI-optimized content delivery, enhancing user rewards in a decentralized ecosystem. TFUEL trades at approximately $0.034 with a market capitalization of $237M. TFUEL powers microtransactions in Theta's ecosystem, enabling earners to monetize bandwidth while AI enhances video quality, creating a utility token for everyday content consumption. Official website: https://www.thetatoken.org

Oasis (ROSE): Oasis, launched in 2020, is a privacy-focused blockchain supporting confidential smart contracts and secure AI model training. The ROSE token powers transactions, staking, and governance, enabling private data collaboration for DeFi and AI applications. ROSE trades at approximately $0.024 with a market capitalization of $182M. Oasis's confidential compute allows private AI training on sensitive data, with Sapphire enabling EVM-compatible privacy, unlocking use cases in healthcare and finance without data leakage. Official website: https://oasisprotocol.org

Golem (GLM): Golem, launched in 2016, is a decentralized compute marketplace allowing users to rent unused computing power for AI and other tasks. The GLM token facilitates payments and incentivizes providers, creating a peer-to-peer supercomputer for global access. GLM trades at approximately $0.22 with a market capitalization of $228M. Golem's global supercomputer harnesses idle CPUs/GPUs for AI rendering, with task verification ensuring reliable results, offering affordable compute for researchers and developers worldwide. Official website: https://www.golem.network

OriginTrail (TRAC): OriginTrail, launched in 2018, is a decentralized knowledge graph ensuring supply chain transparency with AI-driven data analysis. The TRAC token facilitates fees, data sharing, and governance, supported by alliances with Deloitte and Emurgo. TRAC trades at approximately $0.39 with a market capitalization of $194M. OriginTrail's knowledge graph integrates AI for verifiable supply chain insights, combating fraud with immutable data, used by enterprises for traceability in food and pharmaceuticals. Official website: https://origintrail.io

PAAL AI (PAAL): PAAL AI, launched in 2023, enhances user interaction with blockchain through AI-powered tools and insights, focusing on personalized crypto experiences. The PAAL token drives ecosystem transactions and rewards, blending AI with community-driven DeFi solutions. PAAL trades at approximately $0.09 with a market capitalization of $91M. PAAL's AI agents provide personalized trading signals and portfolio management, with token utilities in staking and governance, creating an intuitive interface for crypto newcomers. Official website: https://paalai.io

Threshold (T): Threshold, formed in 2022 from the merger of NuCypher and Keep Network, provides decentralized key management and encryption for privacy-focused AI and DeFi applications. The T token governs and incentivizes node operators, ensuring secure data handling. T trades at approximately $0.015 with a market capitalization of $159M. Threshold's distributed key generation enables private AI computations and tBTC for Bitcoin DeFi, enhancing privacy without single points of failure in multi-party encryption. Official website: https://threshold.network

Flux (FLUX): Flux, launched in 2018, offers a decentralized cloud computing platform for AI and dApps, powered by a network of nodes providing computational resources. The FLUX token supports transactions, staking, and governance, enabling scalable, censorship-resistant infrastructure. FLUX trades at approximately $0.20 with a market capitalization of $76M. Flux's PoUW consensus rewards useful compute, supporting AI workloads across 15,000 nodes, with parallel assets on multiple chains for seamless multi-cloud operations. Official website: https://runonflux.io

Delysium (AGI): Delysium, launched in 2022, is an AI-driven blockchain platform enabling virtual worlds and autonomous agents for gaming and metaverse applications. The AGI token powers transactions and governance, fostering immersive, decentralized AI ecosystems. AGI trades at approximately $0.04 with a market capitalization of $64M. Delysium's Lucy AI orchestrates virtual agents in metaverses, with blockchain ensuring ownership of AI-generated content, blending gaming with autonomous economies for immersive experiences. Official website: https://www.delysium.com

Sleepless AI (AI): Sleepless AI, launched in 2023, integrates AI with blockchain to create immersive gaming and virtual companion experiences, leveraging AI for dynamic user interactions. The AI token drives ecosystem transactions and rewards, enhancing decentralized entertainment. AI trades at approximately $0.11 with a market capitalization of $43M. Sleepless AI's emotional companions use NLP for personalized interactions, with blockchain tokenomics rewarding engagement, pioneering AI-driven social gaming in Web3. Official website: https://www.sleeplessai.net

Real-World-Assets (RWA):

The most successful real world assets are blockchain projects. RWA projects integrate crypto in a variety of ways including tokenization of tangible and intangible assets, fractional ownership for broader accessibility, and enhanced liquidity through on-chain trading. These projects focus primarily on bridging traditional finance with decentralized ecosystems, enabling secure representation of assets like stocks, real estate, commodities, bonds, and art on blockchain networks without intermediaries. The mission of the Normal RWA Index is to provide reliable exposure to the fast-growing RWA sector and its overlap with crypto. Keeping track of new projects, and more importantly which ones provide the most long-term value, is difficult. This index seeks to simplify investing in this sector of crypto as things change quickly.

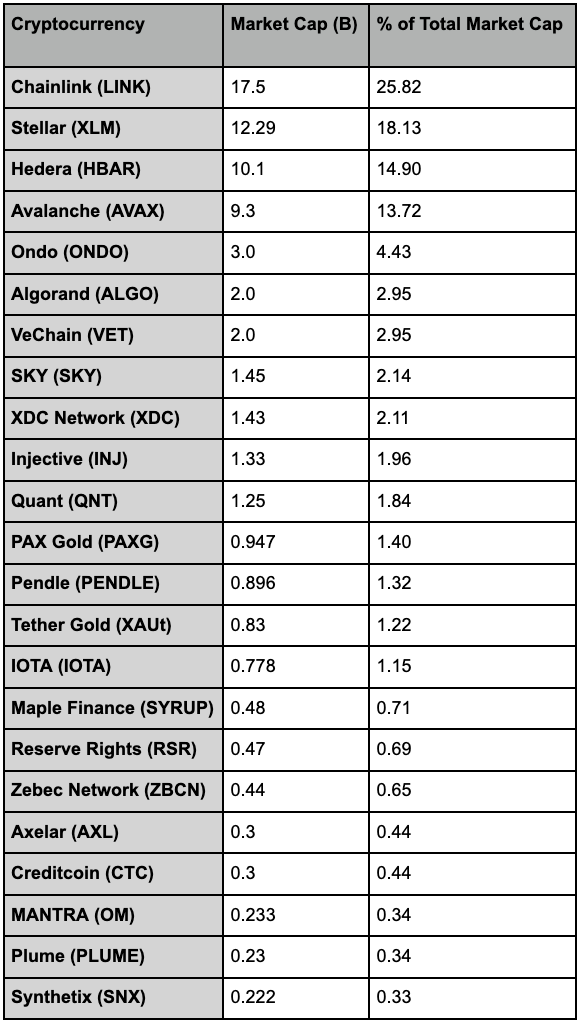

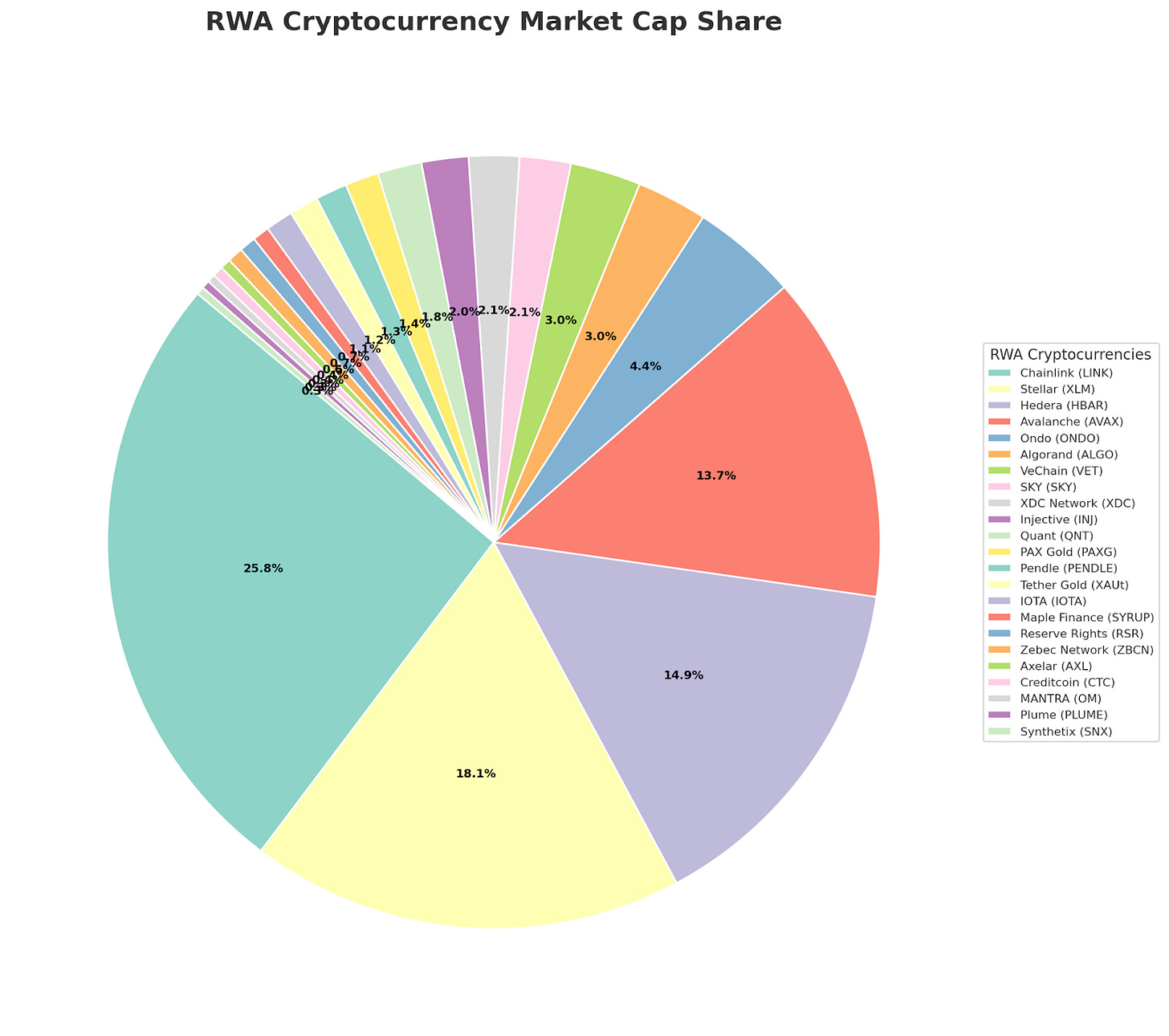

👉 Total Market Cap (RWA basket): ≈ $67.8B

Chainlink (LINK): Chainlink, established in 2017 by Sergey Nazarov, revolutionizes blockchain connectivity as a decentralized oracle network, securely bridging smart contracts with real-world data sources. Facilitating tamper-proof information feeds for prices, events, and APIs, it underpins DeFi, NFTs, and insurance protocols with reliable off-chain inputs. Powered by its LINK token for incentives and staking, Chainlink ensures verifiability and resilience, enabling trustless execution in a hybrid on-chain-off-chain framework. LINK trades at approximately $25.81 with a market capitalization of $17.5B Chainlink's verifiable randomness and data feeds secure RWA tokenization, enabling accurate pricing for trillions in assets, with its Functions for custom computations expanding hybrid smart contracts. Official website: https://chain.link

Stellar (XLM): Stellar, conceived in 2014 by Jed McCaleb, facilitates seamless cross-border payments through its open-source blockchain, connecting financial institutions and individuals with low-cost, rapid transfers. Utilizing the Stellar Consensus Protocol for efficiency and inclusivity, it supports tokenized assets and remittances, bridging traditional finance and digital currencies. Its XLM token powers transactions and anti-spam measures, embodying a mission to democratize global finance with accessibility and transparency. XLM trades at approximately $0.39 with a market capitalization of $12.29B. Stellar's anchor system tokenizes fiat and RWAs for instant settlement, with partnerships like MoneyGram enhancing remittance corridors, making it a low-cost bridge for global asset transfers. Official website: https://stellar.org

Hedera (HBAR): Hedera, powered by hashgraph consensus since 2018, delivers enterprise-grade performance with high-speed, low-cost transactions for applications in finance, supply chains, and beyond. Founded by Leemon Baird and Mance Harmon, it emphasizes security through asynchronous Byzantine fault tolerance and decentralized governance. The HBAR token fuels operations, staking, and micropayments, positioning Hedera as a sustainable alternative to traditional blockchains. HBAR trades at approximately $0.24 with a market capitalization of $10.1B. Hedera's ABFT consensus offers finality in seconds for RWA tracking, with governing council ensuring enterprise trust, ideal for tokenized bonds and supply chains with ESG certification. Official website: https://hedera.com

Avalanche (AVAX): Avalanche, launched in 2020 by Ava Labs, redefines scalability with its subnet architecture, enabling customizable blockchains for high-throughput applications in DeFi, NFTs, and enterprise solutions. Employing proof-of-stake and multiple virtual machines, it achieves sub-second finality and energy efficiency. The AVAX token secures the network via staking and governance, empowering a flexible, interoperable ecosystem for global adoption. AVAX trades at approximately $22.88 with a market capitalization of $9.3B. Avalanche's subnets enable compliant RWA platforms with custom rules, supporting tokenized funds and securities, with fast finality attracting institutions like J.P. Morgan. Official website: https://avax.network

Ondo (ONDO): Ondo, launched in 2022, specializes in tokenizing real-world assets, providing on-chain access to high-quality financial products like U.S. Treasuries through structured finance protocols. Bridging traditional finance and DeFi, it offers yield-bearing tokens and liquidity solutions for institutional-grade investments. The ONDO token governs the platform, enabling staking and participation, fostering a secure, compliant ecosystem for asset tokenization. ONDO trades at approximately $0.98 with a market capitalization of $3B. Ondo's flux tokens provide on-chain exposure to U.S. Treasuries with daily yields, blending DeFi liquidity with TradFi stability, managing billions in tokenized government securities for accredited investors. Official website: https://ondo.finance

Algorand (ALGO): Algorand, founded in 2017 by Silvio Micali, is a high-performance blockchain emphasizing scalability, security, and decentralization through pure proof-of-stake consensus. Supporting DeFi, NFTs, and enterprise applications with low fees and instant finality, it promotes sustainability and inclusivity. The ALGO token facilitates transactions, staking, and governance, driving innovation in a carbon-negative network. ALGO trades at approximately $0.23 with a market capitalization of $2B. Algorand's pure PoS and quantum-resistant cryptography ensure secure RWA tokenization, with instant finality for high-value transfers, adopted by nations for digital currencies and assets. Official website: https://algorand.com

VeChain (VET): VeChain, established in 2015, optimizes supply chain management through blockchain, enhancing transparency, traceability, and efficiency for industries like luxury goods and logistics. Utilizing dual-token economics with VET and VTHO, it enables secure data sharing and smart contracts. The VET token powers governance and staking, positioning VeChain as a leader in enterprise blockchain adoption. VET trades at approximately $0.25 with a market capitalization of $2B. VeChain's ToolChain platform tokenizes physical assets for verifiable supply chains, with partnerships like Walmart China tracking products, reducing fraud and enhancing ESG reporting. Official website: https://www.vechain.org

XDC Network (XDC): XDC Network, launched in 2019 by XinFin, blends public and private blockchain features for hybrid enterprise solutions, focusing on trade finance and global payments. Employing delegated proof-of-stake for energy efficiency, it supports smart contracts and interoperability. The XDC token facilitates transactions, staking, and governance, empowering a scalable, ISO-compliant ecosystem. XDC trades at approximately $0.08 with a market capitalization of $1.43B. XDC's ISO 20022 compliance enables seamless trade finance tokenization, with hybrid chains for private RWAs, bridging traditional banking with blockchain for efficient global settlements. Official website: https://xdc.org

SKY (SKY): SKY, rebranded from Maker in 2024, governs the Sky ecosystem, formerly known for the Dai stablecoin, emphasizing decentralized lending and stability. It enables community-driven decisions on protocol parameters, ensuring resilience and innovation in DeFi. The SKY token facilitates staking, governance, and incentives, upholding a legacy of algorithmic stability and financial sovereignty. SKY trades at approximately $0.062 with a market capitalization of $1.45B. SKY's upgrade from Maker introduces USDS and reward programs, maintaining over-collateralized stability for RWAs, with governance enhancing user incentives in decentralized finance. Official website: https://sky.money